A cryptocurrency address is a unique string of characters used to receive digital assets. Think of it as an account number in the traditional banking system. However, unlike bank account numbers, these addresses are not tied to a centralized institution but operate on decentralized blockchain networks.

Structure and Composition of Addresses

Currency addresses generally comprise a mix of alphanumeric characters, with their length and structure contingent upon the specific cryptocurrency. To illustrate, Bitcoin addresses span from 26 to 35 characters. Conversely, Ethereum addresses uniformly commence with ‘0x’, succeeded by a string of alphanumeric characters. These unique identifiers are generated from cryptographic keys, a process that safeguards the integrity and legitimacy of transactions.

Types of Cryptocurrency Addresses

There are different types of cryptocurrency addresses based on their use and the kind of transactions they support:

- Public Address: This is the address you share with others to receive funds. It’s derived from a public key and is safe to share.

- Private Address (or Key): This is a secret address that allows owners to spend funds from the public address associated with it. It’s crucial to keep this private.

- Multi-signature Address: This type of address requires multiple private keys to authorize a transaction, adding an extra layer of security.

Safety and Security Measures

Given the decentralized nature of cryptocurrencies, the security of addresses is paramount. Some measures include:

Using Hardware Wallets: These are physical devices that store private keys offline, ensuring they are safe from online hacks.

Regularly Updating Wallet Software: This ensures that one’s wallet has the latest security enhancements.

Avoiding Public Wi-Fi: Public networks can be insecure and prone to attacks.

Comparison Table: Cryptocurrency Addresses vs. Traditional Banking Details

| Aspect | Cryptocurrency Addresses | Traditional Banking Details |

|---|---|---|

| Centralization | Decentralized | Centralized (Banks/Financial Institutions) |

| Anonymity | Pseudonymous (Addresses aren’t directly tied to personal identities) | Personal Details are attached |

| Global Reach | Universal (Same format globally) | Varies by country and bank |

| Transaction Speed | Varies (Instant to 10+ minutes) | Hours to days |

| Security | Cryptographic security | Multi-layered (e.g., OTP, PIN) |

Understanding the Mechanics of Crypto Addresses

At the heart of every cryptocurrency transaction lies a crypto address—a digital destination for funds. Much like a postal address or an email, it’s a unique identifier, but for digital assets. However, the mechanics behind these addresses are far more complex and secure than their traditional counterparts.

The Genesis: How Crypto Addresses are Born

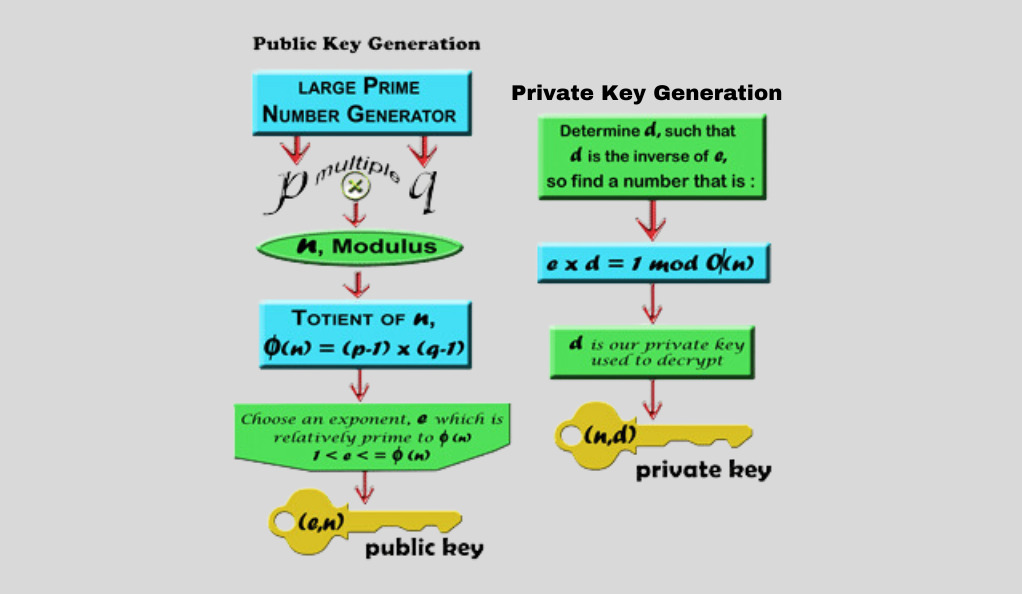

Every crypto address originates from a cryptographic process:

- Private Key Generation: It all starts with a private key, a random sequence of numbers and letters. This key is kept secret and acts as a digital signature for transactions.

- Public Key Derivation: From the private key, a public key is derived using elliptic curve multiplication, a one-way cryptographic function.

- Address Creation: The public key undergoes further cryptographic transformations, including hashing functions like SHA-256, to produce the final crypto address.

Structure and Composition

A cryptocurrency address is commonly a sequence of alphanumeric characters, and its structure and length differ depending on the specific cryptocurrency:

For Bitcoin, addresses encompass a range of 26 to 35 characters. In the case of Ethereum, addresses invariably begin with ‘0x’, succeeded by a string of 40 hexadecimal characters. Despite these variations, the fundamental purpose of all these addresses remains consistent: to securely denote a destination within their corresponding blockchain networks.

Types and Variations of Crypto Addresses

- Standard Addresses: The most common type, used for regular transactions.

- Multi-signature Addresses: Require multiple private keys for authorization, enhancing security.

- Stealth Addresses: Allow for privacy by creating a new address for each transaction.

- Segregated Witness (SegWit) Addresses: A Bitcoin-specific address type that offers faster transaction times and better scalability.

Safety Protocols and Best Practices

Given the irreversible nature of blockchain transactions, ensuring the security of crypto addresses is paramount:

Always Double-Check: Before making a transaction, verify the address.

Use QR Codes: Scanning a QR code is often safer than manually entering an address.

Keep Private Keys Private: Never share your private key. It’s the gateway to your funds.

Comparison Table: Crypto Addresses vs. Traditional Digital Identifiers

| Aspect | Crypto Addresses | Traditional Digital Identifiers |

|---|---|---|

| Centralization | Decentralized | Centralized (e.g., Email servers) |

| Anonymity | Pseudonymous | Typically tied to personal details |

| Security | Cryptographic algorithms | Password-based security |

| Purpose | Digital asset transactions | Communication or identification |

Locating and Using Your Crypto Wallet Address

In the vast expanse of the cryptocurrency universe, your crypto wallet address serves as your unique digital identity. It’s the key to managing, transferring, and receiving your digital assets, making it an essential tool for any crypto enthusiast.

What is a Crypto Wallet Address?

A crypto wallet address is a string of alphanumeric characters that represents a destination or origin for a cryptocurrency transaction. Think of it as the digital equivalent of a bank account number. However, unlike traditional bank accounts, these addresses aren’t tied to personal identities, offering a layer of pseudonymity.

Steps to Locate Your Crypto Wallet Address

a. Accessing Your Wallet: Begin by logging into your crypto wallet, whether it’s a hardware wallet, software wallet, or an exchange platform.

b. Navigating the Interface: Typically, there will be sections labeled ‘Receive’ or ‘Deposit’. Click on this.

c. Displaying the Address: Post navigation, your unique crypto wallet address will be displayed, often accompanied by a QR code for easier transactions.

d. Copying the Address: Most platforms offer a ‘copy to clipboard’ option to ensure accuracy when sharing your address.

Using Your Address: Sending and Receiving Cryptocurrencies

- Receiving Cryptocurrencies: Share your wallet address with the sender. They’ll input it as the destination, and once the transaction is confirmed on the blockchain, you’ll see the funds in your wallet.

- Sending Cryptocurrencies: If you’re sending assets, you’ll need the recipient’s wallet address. Input this into the ‘Send’ or ‘Withdraw’ section of your wallet or exchange.

- Transaction Confirmations: Once a transaction is initiated, it’ll need to be verified by the network. The time this takes can vary based on the cryptocurrency and network congestion.

Safety Tips and Best Practices

- Double-Check Addresses: Always ensure that the address you’re sending to or receiving from is correct. A single mistake can result in lost assets.

- Use QR Codes: Scanning a QR code minimizes the risk of errors when inputting an address.

- Never Share Private Keys: While your public address is safe to share, your private keys (which grant access to your funds) should remain confidential.

The Different States of a Crypto Wallet Address

Crypto wallet addresses aren’t static entities. They transition through various states, each with its implications and nuances. Understanding these states is crucial for anyone delving into the world of digital currencies.

Defining a Crypto Wallet Address

A crypto wallet address is a unique string of alphanumeric characters representing a specific destination on a blockchain network. It’s akin to an account number, facilitating the sending and receiving of digital assets.

The Various States of a Crypto Wallet Address

- New (Unused) Address: This is an address that has never been used for any transaction. It’s pristine and has no transaction history associated with it.

- Active Address: An address that has recent transaction activity. It’s been used to send or receive cryptocurrencies within a specific timeframe, often the last 24 hours.

- Dormant Address: An address with no recent transaction activity. It might have been used in the past but has been inactive for a significant period.

- Legacy Address: Specific to Bitcoin, these are addresses from Bitcoin’s original address format. They start with a ‘1’.

- SegWit Address: Another Bitcoin-specific state, representing the newer address format introduced to improve scalability. These addresses usually start with a ‘3’ or ‘bc1’.

Implications of Each State

In the realm of cryptocurrency addresses, various types serve distinct purposes:

An unused address, termed “New,” is favored for safeguarding privacy due to its lack of transaction history; however, its secure storage is paramount from the outset.

An “Active” address indicates ongoing trading or transaction engagement. Yet, employing the same address repeatedly can jeopardize privacy.

“Dormant” addresses, whether holding assets long-term or simply disused, require monitoring, especially if they hold substantial value.

“Legacy” addresses, functional but comparatively slower and costlier in transactions, coexist with their more efficient SegWit counterparts, which offer swifter and more economical transactions through enhanced scalability features.

Safety Measures for Different Address States

To ensure safety across different address states, it’s vital to securely store and limit sharing of “New” addresses, enhance privacy by using fresh addresses for each transaction with “Active” addresses, regularly verify and bolster security for private keys associated with “Dormant” addresses, optimize transaction efficiency by potentially migrating assets from “Legacy” addresses to SegWit addresses, and maintain up-to-date security by consistently updating wallet software linked to “SegWit” addresses.

Active vs. New Addresses: Key Differences

Crypto wallet addresses serve as unique identifiers in the blockchain world, facilitating the transfer and receipt of digital assets. However, not all addresses are created equal. Their state—whether new or active—can have varying implications for users.

Defining New Addresses

A new (or unused) address is one that has never been involved in any transaction on its respective blockchain. It’s a pristine identifier, devoid of any transaction history.

- Generation: Created when a user sets up a new wallet or requests a fresh address from their existing wallet.

- Privacy: Offers maximum privacy since there’s no transactional history linked to it.

Understanding Active Addresses

An active address is one that has recent transaction activity. It has been used to send or receive digital assets, often within a specific timeframe like the past 24 hours.

- Frequency: An address remains active as long as it engages in regular transactions.

- History: Every transaction involving an active address is recorded on the blockchain, making its history transparent and immutable.

Key Differences Between Active and New Addresses

a. Transaction History:

- New: No transaction history.

- Active: Has a record of past transactions.

b. Privacy Level:

- New: Maximum privacy due to the absence of prior transactions.

- Active: Reduced privacy, especially if the same address is reused multiple times.

c. Purpose:

- New: Often used for long-term holdings or when maximum privacy is desired.

- Active: Commonly used for regular trading or frequent transactions.

Implications and Use Cases for Each Address Type

a. New Addresses:

Security: Ideal for storing large amounts of assets due to their untouched status.

Anonymity: Preferred when conducting transactions that require high levels of privacy.

b. Active Addresses:

Liquidity: Suitable for traders and those engaging in regular transactions.

Transparency: Beneficial for public entities or fundraisers that want to maintain transparency in their transactions.

The Security Implications of Address Linking

In the decentralized world of cryptocurrencies, address linking can be both a boon and a bane. While it can offer insights and streamline processes, it also comes with potential security implications that every user should be aware of.

What is Address Linking?

Address linking refers to the process of associating two or more cryptocurrency addresses, often to identify that they belong to the same user or entity. This can be done through transactional patterns, shared funds, or other on-chain activities.

Potential Security Risks of Address Linking

- Loss of Privacy: Once addresses are linked, the associated transaction histories become transparent, potentially revealing a user’s financial behaviors and holdings.

- Target for Malicious Actors: Linked addresses with significant holdings can become targets for hackers or phishing attacks.

- Association with Illicit Activities: If one linked address engages in illegal activities, other linked addresses might face unwarranted scrutiny.

- Reduced Fungibility: If certain coins within a linked address are flagged (e.g., from a hack), they might be treated differently, undermining the principle of fungibility.

Benefits of Address Linking in Certain Scenarios

a. Enhanced User Experience: Services can streamline processes by recognizing returning users through address linking.

b. Fraud Detection: Suspicious patterns can be identified when multiple addresses are linked, aiding in fraud prevention.

c. Regulatory Compliance: For platforms that need to adhere to regulatory standards, address linking can assist in Know Your Customer (KYC) and Anti-Money Laundering (AML) processes.

Address Linking and Pseudonymity

Cryptocurrencies, by design, offer pseudonymity—not complete anonymity. Address linking can further erode this pseudonymity. While addresses themselves don’t reveal personal identities, linking them can provide enough data for third parties to potentially deduce user identities, especially when combined with off-chain data.

Comparison Table: Address Linking vs. Traditional Financial Linkages

| Aspect | Address Linking | Traditional Financial Linkages |

|---|---|---|

| Privacy Level | Pseudonymous | Typically tied to personal identities |

| Security Risks | Potential target for hackers, Loss of privacy | Data breaches, Identity theft |

| Benefits | Fraud detection, Enhanced user experience | Credit history tracking, Fraud detection |

| Regulatory Implications | Varies by jurisdiction | Standardized across financial institutions |

Address Linking and Market Dynamics

In the decentralized world of cryptocurrencies, every transaction leaves a trace. Address linking, the practice of associating multiple addresses, can provide insights into these traces, influencing market perceptions and behaviors.

Understanding Address Linking in Depth

Address linking refers to the process of connecting two or more cryptocurrency addresses, suggesting they belong to the same entity. This connection can be inferred from transaction patterns, shared funds, or other on-chain activities.

How Address Linking Influences Market Dynamics

- Market Sentiment: Large transactions between linked addresses, especially if identified as belonging to influential entities or ‘whales’, can sway market sentiment, leading to price surges or drops.

- Trading Strategies: Traders often monitor linked addresses for patterns, adjusting their strategies based on the perceived actions of major players.

- Transparency vs. Manipulation: While address linking can enhance market transparency, it can also be used maliciously. For instance, entities might shuffle funds between linked addresses to give the illusion of market activity.

- Regulatory Scrutiny: Linked addresses that show patterns of dubious activities can attract regulatory attention, potentially impacting market dynamics.

Address Linking and Whale Movements

‘Whales’, or large holders of cryptocurrencies, have a significant impact on market dynamics. Address linking can:

a. Reveal Whale Strategies: By monitoring the activity of linked addresses associated with whales, traders can glean insights into potential market moves.

b. Trigger Panic Selling or Buying: If a whale-linked address starts selling large quantities, it might trigger panic selling. Conversely, large purchases can spur buying frenzies.

The Role of Anonymity Services and Address Linking

To counteract address linking, many turn to anonymity services or mixers:

a. Market Impact: The use of mixers can obscure whale movements, leading to unexpected market shifts when large transactions are suddenly revealed.

b. Regulatory Challenges: Anonymity services make regulatory oversight challenging, potentially leading to stricter regulations that impact market dynamics.

Conclusion

As the cryptocurrency ecosystem continues its rapid evolution, the practice of address linking stands at a pivotal juncture. On one hand, it promises enhanced transparency, enabling market participants to make more informed decisions by tracking the flow of assets and identifying influential entities. On the other, it raises pressing concerns about privacy and the potential for market manipulation. With emerging technologies like zero-knowledge proofs and increased regulatory scrutiny, the future of address linking will likely be a delicate balance between ensuring market integrity and preserving user anonymity. This interplay will shape the trajectory of the crypto landscape, underscoring the need for continuous innovation and thoughtful regulation.

At bitvestment.software, our commitment is to deliver unbiased and reliable information on subjects like cryptocurrency, finance, trading, and stocks. It's crucial to understand that we are not equipped to offer financial advice, and we actively encourage users to conduct their own comprehensive research.

Read More