The world of finance has always been dynamic, with innovations often reshaping the landscape. One such innovation that has garnered significant attention in recent years is the Bitcoin Exchange-Traded Fund (ETF). As we delve into this topic, it’s crucial to understand the foundational concepts and the significance of Bitcoin ETFs in the broader financial ecosystem.

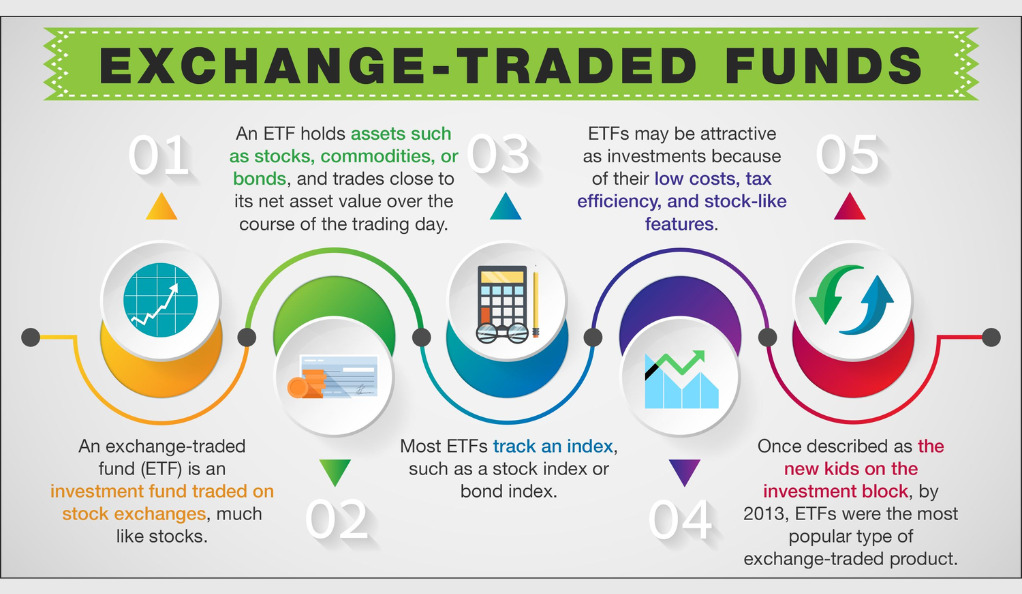

What is an ETF?

An Exchange-Traded Fund (ETF) is a type of investment fund and exchange-traded product, with shares that are tradable on a stock exchange. ETFs are designed to track the performance of a specific index, sector, commodity, or asset. They offer a way for investors to buy a broad portfolio of assets, without having to purchase each one individually.

Table 1: Traditional ETF vs. Bitcoin ETF

| Criteria | Traditional ETF | Bitcoin ETF |

|---|---|---|

| Underlying Asset | Stocks, Bonds, Commodities, etc. | Bitcoin (BTC) |

| Purpose | Track performance of a specific index/sector | Track the performance of Bitcoin’s price |

| Liquidity | High (tradable on stock exchanges) | Depends on the ETF’s adoption and approval |

| Regulation | Regulated by financial authorities | Subject to additional scrutiny and concerns |

Why are Bitcoin ETFs Significant?

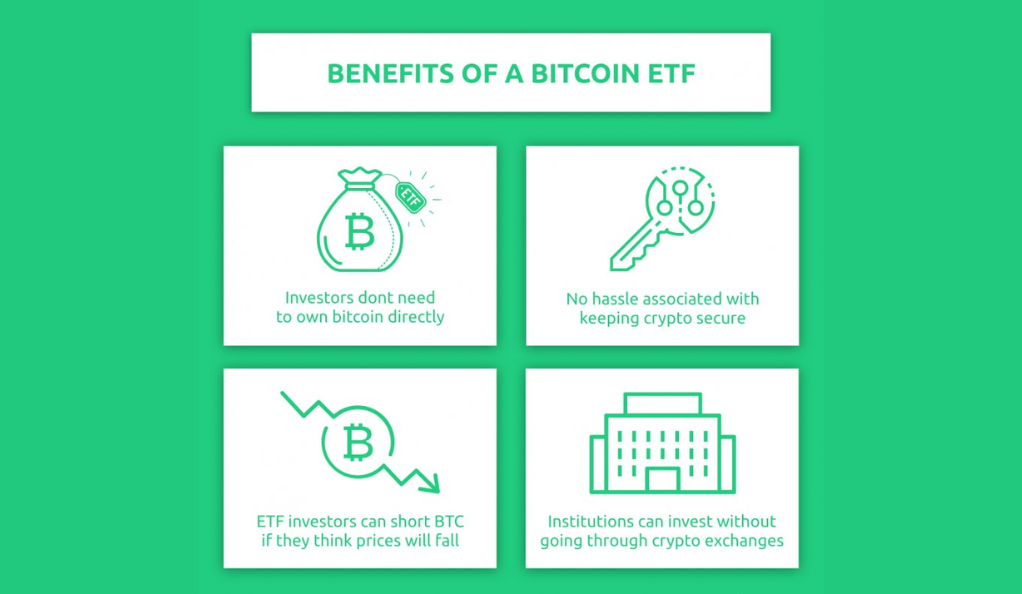

Bitcoin, the pioneering cryptocurrency, has seen exponential growth and adoption since its inception in 2009. However, for many institutional investors, direct investment in Bitcoin remains a challenge due to regulatory concerns, custody issues, and the technical complexities of managing private keys.

This is where Bitcoin ETFs come into play. They provide a bridge between the traditional financial world and the burgeoning realm of cryptocurrencies. By offering exposure to Bitcoin in a format that institutional investors are familiar with, Bitcoin ETFs have the potential to:

- Democratize Access: Allow a broader range of investors to gain exposure to Bitcoin without the need to buy the cryptocurrency directly.

- Enhance Liquidity: As more institutions and retail investors get involved, the liquidity of Bitcoin could see a significant boost.

- Strengthen Legitimacy: Regulatory approval of Bitcoin ETFs could further legitimize cryptocurrency as a mainstream investment.

The Growing Institutional Interest

Over the past few years, there’s been a noticeable shift in sentiment. The once skeptical institutional investors are now showing a keen interest in the crypto space. The allure of high returns, coupled with the maturing infrastructure around cryptocurrency, has made it hard to ignore. Bitcoin ETFs, in this context, are viewed as a potential on-ramp for these institutions to enter the crypto economy.

The Evolution of Bitcoin ETFs

The journey of Bitcoin ETFs is a testament to the evolving relationship between traditional finance and the world of cryptocurrencies. To appreciate the current state of Bitcoin ETFs, it’s essential to trace their evolution and understand the milestones that have shaped their trajectory.

The Early Days: Initial Proposals and Rejections

The idea of a Bitcoin ETF isn’t new. The first proposals for such a financial instrument were submitted to regulatory bodies as early as 2013. These early proposals were met with skepticism, primarily due to:

- Regulatory Concerns: The decentralized nature of Bitcoin raised questions about its susceptibility to fraudulent activities and market manipulation.

- Market Maturity: The cryptocurrency market, being in its nascent stage, was perceived as highly volatile and unpredictable.

- Custody Issues: Traditional financial institutions were unsure about the safekeeping of digital assets, given the unique challenges associated with crypto custody.

Despite these concerns, the proponents of Bitcoin ETFs remained undeterred, refining their proposals and seeking ways to address regulatory apprehensions.

The Role of the U.S. Securities and Exchange Commission (SEC)

The United States Securities and Exchange Commission (SEC) has played a pivotal role in the evolution of Bitcoin ETFs. As the primary regulatory body overseeing securities in the U.S., the SEC’s stance on Bitcoin ETFs has been closely watched by the global financial community.

Over the years, the SEC has:

- Requested Public Feedback: In its bid to understand the market better, the SEC has often sought public comments on specific Bitcoin ETF proposals, gauging the sentiment of both industry insiders and the general public.

- Outlined Concerns: The SEC has been vocal about its reservations, particularly regarding market manipulation and the lack of a regulated market of significant size for Bitcoin.

- Engaged with Proponents: Recognizing the growing interest in Bitcoin ETFs, the SEC has engaged in dialogues with ETF proponents, seeking clarifications and additional data to inform its decisions.

A Turning Tide: Shifting Sentiments and Approvals

While the initial years were marked by rejections and delays, the tide began to turn around 2019. Several factors contributed to this shift:

- Market Maturation: The cryptocurrency market started showing signs of maturity, with better liquidity, more robust infrastructure, and enhanced regulatory oversight.

- Institutional Interest: As major financial institutions began to explore and invest in cryptocurrencies, their legitimacy in the eyes of regulators improved.

- Improved Proposals: ETF proponents began to address the SEC’s concerns more effectively, offering solutions for custody, ensuring transparency, and proposing mechanisms to prevent market manipulation.

By 2021, several countries, including Canada and Brazil, had approved and launched their Bitcoin ETFs, setting a precedent and increasing pressure on the U.S. regulators to reconsider their stance.

The Current State of Bitcoin ETFs

The narrative surrounding Bitcoin ETFs has been one of anticipation, hope, and at times, disappointment. However, recent developments indicate a changing tide, with the crypto and traditional finance worlds inching closer than ever before.

Spot Bitcoin ETFs

While the U.S. has been cautious in its approach to Bitcoin ETFs, Europe has taken significant strides. In 2023, the first European spot Bitcoin ETF was launched on the Euronext Amsterdam stock exchange. This marked a significant milestone, not just for Europe but for the global financial community, signaling a growing acceptance of cryptocurrencies in mainstream finance.

Table 2: U.S. vs. European Bitcoin ETF Landscape

| Criteria | U.S. | Europe |

|---|---|---|

| Regulatory Stance | Cautious, with concerns about market manipulation and volatility | More receptive, with several ETFs approved |

| Major Players | Awaiting SEC’s green light for multiple applications | Jacobi Bitcoin ETF on Euronext Amsterdam |

| Market Response | Anticipation and keen interest from institutional investors | Positive reception with significant trading volumes |

U.S. Delays

The U.S. remains a focal point in the Bitcoin ETF discussion, given its influence on global financial markets. The SEC, while acknowledging the growing demand, has adopted a wait-and-see approach. With a maximum 240-day window available for the SEC to delay crypto ETF applications, some firms might have to wait until 2024 for decisions on filings made in 2023. This prolonged timeline has led to a mix of frustration and hope among proponents.

Broader Implications

The significance of Bitcoin ETFs extends beyond just offering an investment avenue. Their acceptance and proliferation have broader implications:

- Market Stability: With more institutional players involved, the crypto market could benefit from enhanced stability and reduced volatility.

- Mainstream Adoption: Bitcoin ETFs can act as a gateway for many who are hesitant about entering the crypto space, further driving mainstream adoption.

- Innovation Boost: The success of Bitcoin ETFs could pave the way for other crypto-based financial instruments, fostering innovation in the sector.

Challenges and Concerns

While the potential and promise of Bitcoin ETFs are undeniable, their journey is not without challenges. These hurdles, often rooted in the inherent complexities of the crypto world and the cautious nature of regulatory bodies, have shaped the trajectory of Bitcoin ETFs.

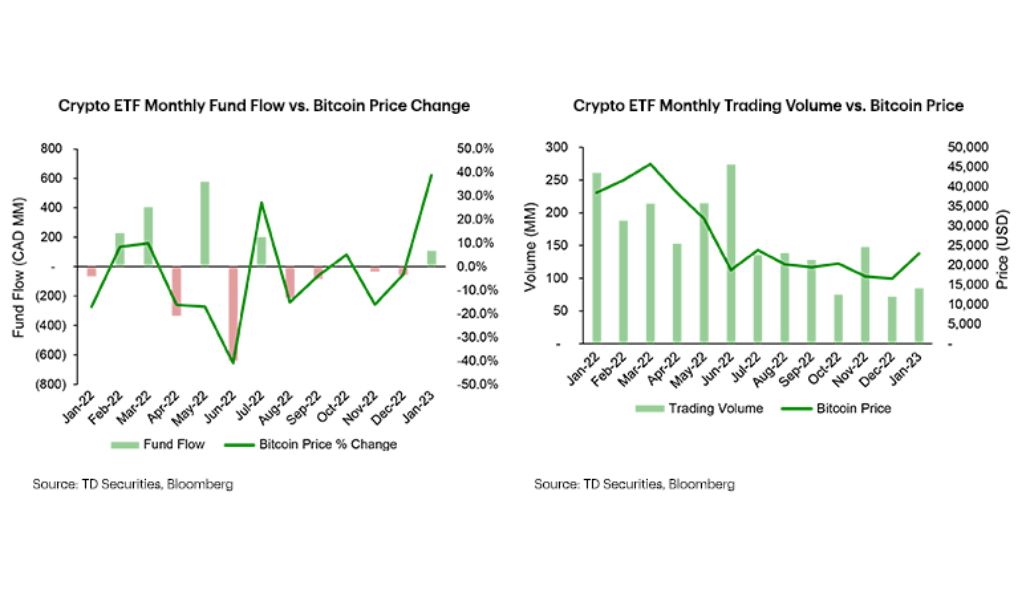

Asset Volatility

Bitcoin, and by extension most cryptocurrencies, is known for its price volatility. While this volatility can offer significant returns, it also presents substantial risks. For regulators, ensuring that retail and institutional investors are protected from extreme market swings is paramount.

Table 3: Bitcoin’s Notable Price Swings in the Past Decade

| Year | Highest Price | Lowest Price | Percentage Change |

|---|---|---|---|

| 2013 | $1,147 | $13.30 | 8,520% |

| 2017 | $19,783 | $778 | 2,442% |

| 2020 | $28,837 | $4,106 | 602% |

| 2023 | $25,903* | TBD | TBD |

Market Maturity

The crypto market, though over a decade old, is still considered young compared to traditional financial markets. This relative infancy brings concerns about market manipulation, liquidity issues, and the overall maturity of the crypto ecosystem.

Regulatory Hurdles

Regulators worldwide grapple with the challenge of accommodating the rapid growth of cryptocurrencies while ensuring investor protection. The decentralized nature of cryptocurrencies, coupled with concerns about their use in illicit activities, has made regulatory approval a complex process.

Section: The SEC’s Concerns Explained

- Market Manipulation: Given the decentralized and global nature of cryptocurrency trading, there are concerns about potential price manipulations in smaller exchanges that could impact the broader market.

- Custody Challenges: Safeguarding digital assets presents unique challenges. Ensuring that ETF providers have robust custody solutions is crucial to prevent potential hacks and unauthorized access.

- Lack of a Regulated Market: The SEC has often cited the absence of a significant regulated market for Bitcoin as a concern, impacting the approval process for Bitcoin ETFs.

The Evolving Investor Profile: Educating the Masses

As Bitcoin ETFs aim to bridge the gap between traditional finance and the crypto world, there’s a pressing need to educate potential investors. Understanding the risks, rewards, and intricacies of crypto investments is crucial to make informed decisions.

The Institutional Perspective

The rise of Bitcoin ETFs isn’t just a story of a new financial product; it’s a narrative of changing institutional perspectives. As the lines between traditional finance and digital assets blur, understanding the institutional viewpoint becomes crucial.

Why Institutions Care

Institutions, from hedge funds to pension funds, have traditionally been risk-averse, opting for stable, long-term investments. However, the potential returns offered by Bitcoin and other cryptocurrencies are hard to ignore. Key driving factors include:

- Diversification: Cryptocurrencies offer a new asset class, uncorrelated to traditional markets, allowing institutions to diversify their portfolios effectively.

- High Potential Returns: Despite its volatility, Bitcoin has consistently showcased significant returns over the past decade, outperforming many traditional assets.

- Growing Legitimacy: As regulations become clearer and the infrastructure around cryptocurrencies matures, the legitimacy of investing in digital assets has increased.

The Bitcoin ETF Advantage

For institutions, direct investment in Bitcoin presents challenges – from safe custody of digital assets to navigating the regulatory landscape. Bitcoin ETFs offer a solution:

- Simplified Exposure: Bitcoin ETFs provide institutions with exposure to Bitcoin’s price without the need to handle the actual cryptocurrency.

- Regulated Framework: ETFs fall within a known regulatory framework, offering institutions a sense of security and compliance.

- Liquidity and Trading: Being traded on stock exchanges, Bitcoin ETFs offer the advantage of high liquidity and the familiarity of traditional trading mechanisms.

Concerns and Considerations

While the advantages are clear, institutions also have concerns:

- Market Volatility: The volatile nature of Bitcoin’s price can impact the value of Bitcoin ETFs, presenting a risk for institutional investors.

- Regulatory Uncertainty: While Bitcoin ETFs offer a regulated way to invest in Bitcoin, the broader regulatory landscape for cryptocurrencies remains in flux in many jurisdictions.

- Underlying Asset Security: Concerns about the security of the Bitcoin underlying the ETFs remain, given the history of hacks and breaches in the crypto space.

A Glimpse into the Future

As the Bitcoin ETF landscape evolves, institutions are likely to adopt various strategies:

- Selective Investment: Institutions might opt for selective investment in Bitcoin ETFs, balancing their portfolios based on risk tolerance.

- Active Engagement: Some institutions might take a more hands-on approach, actively engaging with ETF providers, regulators, and the crypto industry to shape the future of Bitcoin ETFs.

- In-house Solutions: Larger institutions with significant resources might explore creating their own Bitcoin ETFs or similar financial products, leveraging their brand and expertise.

The Future of Bitcoin ETFs

As we stand at the crossroads of traditional finance and the digital revolution brought about by cryptocurrencies, the future of Bitcoin ETFs remains one of the most keenly watched spaces. Drawing from past trends, current developments, and expert predictions, let’s explore what the future might hold.

Regulatory Breakthroughs

While the U.S. has been slow to approve Bitcoin ETFs, the global sentiment is shifting. Countries like Canada, Brazil, and several European nations have already given the green light. This global trend could influence more conservative jurisdictions:

- Harmonized Regulations: As more countries adopt Bitcoin ETFs, there might be a push towards harmonizing regulations, ensuring a consistent framework for investors globally.

- Benchmarking Best Practices: Early adopters of Bitcoin ETFs will serve as case studies, allowing regulators to benchmark best practices and address potential pitfalls.

Technological Advancements

The crypto industry is renowned for its rapid technological advancements. These innovations will undoubtedly influence Bitcoin ETFs:

- Improved Custody Solutions: As the security of digital assets remains paramount, we can anticipate breakthroughs in custody solutions, making it even safer for institutions to back Bitcoin ETFs.

- Integration with Traditional Platforms: Future platforms might seamlessly integrate Bitcoin ETF trading with other traditional assets, offering a unified trading experience.

Market Dynamics

The demand for Bitcoin ETFs is driven by both retail and institutional investors. As this demand grows, the market will respond:

- Diversified Bitcoin ETF Offerings: Beyond just tracking Bitcoin’s price, we might see ETFs offering a mix of various cryptocurrencies or integrating with other financial instruments.

- Price Predictions and Impact: Some experts predict that the approval and widespread adoption of Bitcoin ETFs could drive Bitcoin prices even higher, given the increased accessibility and exposure.

Educating the Masses

As Bitcoin ETFs become mainstream, there will be a growing need to educate potential investors:

- Focused Campaigns: ETF providers, in collaboration with regulators, might launch educational campaigns to inform investors about the intricacies of Bitcoin ETFs.

- Transparent Reporting: To build trust, regular and transparent reporting about the performance, risks, and rewards of Bitcoin ETFs will become crucial.

Potential Challenges

While the future looks promising, it’s also unpredictable. Potential challenges include:

- Market Corrections: Like all assets, Bitcoin is susceptible to market corrections, which could impact Bitcoin ETFs.

- Regulatory Backlashes: Any misuse or fraudulent activities related to Bitcoin ETFs could lead to stricter regulations or even bans in certain jurisdictions.

- Competing Financial Products: As the crypto industry evolves, new financial products might emerge, offering competition to Bitcoin ETFs.

Conclusion

The odyssey of Bitcoin ETFs encapsulates the broader narrative of cryptocurrency’s integration into the global financial fabric. From initial skepticism to cautious optimism, the trajectory of these ETFs mirrors the evolving perceptions of digital assets. As traditional finance and cryptocurrency converge, Bitcoin ETFs stand as a testament to innovation, adaptability, and the relentless pursuit of bridging two worlds. While the road ahead promises both challenges and opportunities, one thing is certain: Bitcoin ETFs have not only etched their mark on the financial landscape but also paved the way for a future where digital and traditional assets coexist in harmony.

At bitvestment.software, our commitment is to deliver unbiased and reliable information on subjects like cryptocurrency, finance, trading, and stocks. It's crucial to understand that we are not equipped to offer financial advice, and we actively encourage users to conduct their own comprehensive research.

Read More