Introduction

Investing is more than just a financial strategy; it’s a cornerstone of building wealth and securing a stable financial future. Whether you’re just starting your career or approaching retirement, understanding how to invest wisely is crucial. However, the approach to investing is not one-size-fits-all. It varies significantly based on age, risk tolerance, financial goals, and life stage. In this article, we’ll explore the importance of investing, compare investment strategies for different ages, and set the stage for a comprehensive guide tailored to your specific needs.

Overview of the Importance of Investing

Investing is the act of allocating money or capital to an endeavor with the expectation of generating an income or profit. It’s not just for the wealthy; it’s a vital tool for anyone looking to grow their financial resources over time. Here’s why investing is essential:

- Wealth Accumulation: Through compound interest, even small investments can grow substantially over time.

- Retirement Planning: Investing in retirement accounts like 401(k)s or IRAs can provide financial security in your later years.

- Financial Goals: Whether it’s buying a home, funding education, or starting a business, investing can help you reach your financial milestones.

- Inflation Protection: By earning a return that outpaces inflation, investing helps preserve the purchasing power of your money.

Brief Comparison of Investment Strategies for Different Ages

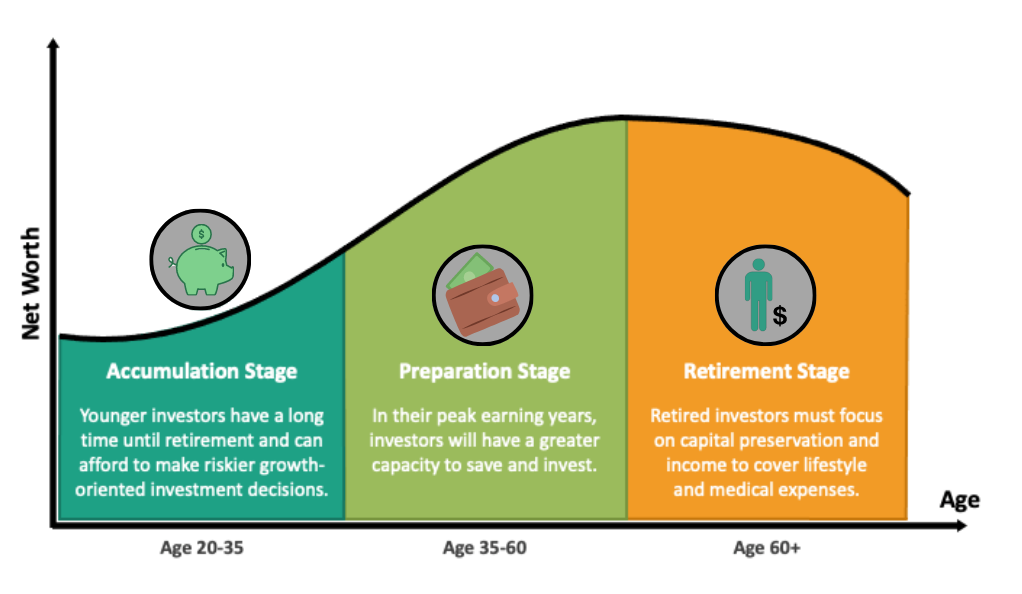

Investment strategies should align with an individual’s age, as risk tolerance, financial needs, and investment horizons change over time. Here’s a brief comparison:

| Age Group | Risk Tolerance | Asset Allocation | Focus |

|---|---|---|---|

| 20s | High | Stocks: 80-90% | Growth, Long-term Potential |

| 50s | Moderate | Stocks: 50-60% | Stability, Retirement Prep |

- 20s: In your 20s, time is on your side. With a longer investment horizon, you can afford to take more risks, focusing on aggressive growth stocks.

- 50s: As you approach retirement, the focus shifts towards preserving capital and generating steady income. The asset allocation becomes more conservative, with a higher percentage in bonds and other stable investments.

Purpose of the Article

This article aims to provide a comprehensive and comparative guide to investing in your 20s versus your 50s. We’ll dive deep into the subject, exploring the nuances of asset allocation, risk management, retirement planning, and more. Whether you’re a young professional looking to maximize growth or in your 50s planning for a comfortable retirement, this guide is designed to equip you with the knowledge and insights you need to make informed investment decisions.

By understanding the unique investment considerations for different life stages, you can tailor your investment strategy to align with your financial goals and risk profile. Stay with us as we explore the fascinating world of investing, offering practical advice, expert insights, and actionable strategies to help you succeed at any age.

Investing in Your 20s: The Time to Take Risks

Investing in your 20s is an exciting and crucial phase of financial planning. It’s a time when you can afford to take risks, explore aggressive growth opportunities, and lay the foundation for long-term financial success. Let’s delve into the key aspects of investing during this vibrant decade of life.

Importance of Starting Early

Starting to invest in your 20s might seem premature, especially when dealing with student loans, starting a career, or other financial commitments. However, the earlier you begin, the more time your investments have to grow. Here’s why starting early matters:

- Time Advantage: The longer your money is invested, the more time it has to compound and grow.

- Risk Management: Starting early allows you to take on more risk, knowing that you have time to recover from potential losses.

- Financial Habits: Building investment habits in your 20s sets the stage for disciplined financial management throughout life.

Risk Tolerance and Aggressive Growth

In your 20s, your risk tolerance is typically higher. You have the time to weather market fluctuations and pursue aggressive growth strategies. Here’s how:

- Growth Stocks: Investing in high-growth companies or sectors can offer substantial returns, albeit with higher volatility.

- Emerging Markets: Exploring opportunities in emerging markets can provide diversification and potential for significant growth.

- Innovative Investments: Consider investing in innovative technologies or startups, areas that might carry higher risk but offer substantial rewards.

Compound Interest and Long-Term Benefits

The magic of compound interest is particularly powerful in your 20s. Here’s how it works:

- Compounding Effect: Interest earned on your investments is reinvested, earning further interest. This cycle continues, leading to exponential growth over time.

- Long-Term Impact: Even small contributions can grow into substantial sums over several decades, thanks to the power of compounding.

- Early Contributions Matter: Money invested in your 20s has more time to compound, often making early contributions more impactful than larger ones made later.

Retirement Accounts and Employer Matching

Retirement might seem a distant concern in your 20s, but it’s the perfect time to start planning. Here’s why:

- 401(k) and IRAs: Contributing to these accounts not only helps in retirement planning but also offers tax benefits.

- Employer Matching: Many employers match a portion of your 401(k) contributions, essentially offering “free money.”

- Roth Options: Consider Roth IRAs or Roth 401(k)s, where contributions are made with after-tax dollars, allowing for tax-free growth and withdrawals.

Investing in your 20s is a unique opportunity to embrace risk, explore growth opportunities, and benefit from the long-term power of compound interest. By understanding your risk tolerance, taking advantage of retirement accounts, and leveraging employer matching, you can set the stage for financial success. It’s a time to be bold, informed, and proactive, laying the groundwork for a prosperous financial future.

Investing in Your 50s: A Shift Towards Stability

Investing in your 50s marks a significant transition in your financial journey. As you approach retirement, the focus shifts from aggressive growth to stability, income generation, and capital preservation. This stage requires a more conservative approach, careful planning, and often, professional guidance. Let’s explore the key aspects of investing during this critical decade.

Nearing Retirement and Conservative Approach

As retirement looms closer, the investment strategy must evolve to reflect the changing financial needs and risk tolerance. Here’s what to consider:

- Risk Reduction: Gradually reducing exposure to high-risk assets like growth stocks helps protect your capital.

- Income Generation: Focus on investments that provide steady income, such as dividend-paying stocks, bonds, or real estate investment trusts (REITs).

- Capital Preservation: Consider more stable investments like government bonds or certificates of deposit (CDs) to preserve capital.

Asset Allocation and Diversification

In your 50s, asset allocation and diversification become paramount. Here’s how to approach it:

- Balanced Portfolio: Aim for a balanced mix of stocks, bonds, and other assets that align with your risk tolerance and retirement goals.

- Diversification: Spread investments across different asset classes, sectors, and geographic regions to reduce risk and enhance stability.

- Reassessment: Regularly reassess your portfolio to ensure it aligns with your changing needs, risk profile, and market conditions.

Catch-Up Contributions and Retirement Planning

Your 50s offer unique opportunities to accelerate retirement savings. Here’s how:

- Catch-Up Contributions: Take advantage of higher contribution limits for 401(k)s and IRAs if you’re aged 50 or older, allowing you to save more.

- Retirement Timeline: Define a clear retirement timeline, considering factors like Social Security benefits, pensions, and healthcare needs.

- Estate Planning: Consider estate planning, including wills, trusts, and power of attorney, to ensure your financial legacy is well-managed.

Importance of Professional Advice

Investing in your 50s often requires nuanced decisions and careful planning. Professional advice can be invaluable:

- Financial Advisors: Consider working with a financial advisor to create a personalized investment strategy, considering your specific goals and risk profile.

- Tax Planning: Engage in tax-efficient investing, considering the impact of taxes on withdrawals, capital gains, and other financial decisions.

- Retirement Specialists: Consult with retirement planning specialists to navigate complex issues like Medicare, Social Security, and pension optimization.

Investing in your 50s is a time for wisdom, foresight, and careful planning. It’s about striking the right balance between growth and stability, maximizing opportunities like catch-up contributions, and seeking professional guidance when needed. By adopting a conservative approach, diversifying assets, and focusing on retirement planning, you can pave the way for a comfortable and secure retirement. It’s a time to reflect, strategize, and prepare for the exciting next chapter of life.

Asset Allocation: A Key Concept

Asset allocation is a fundamental concept in investment management that plays a vital role in determining the risk and return profile of an investment portfolio. It’s about strategically dividing investments across various asset classes to achieve a desired balance of risk and reward.

Asset allocation refers to the process of spreading investments across different asset classes, such as stocks, bonds, and cash, to achieve diversification and align with an investor’s financial goals, risk tolerance, and investment horizon. Here’s why it’s essential:

- Risk Management: By diversifying across different asset classes, you reduce the risk of significant losses if one asset class underperforms.

- Return Optimization: A well-balanced portfolio can provide a more consistent return by capitalizing on the strengths of various asset classes.

- Strategic Alignment: Asset allocation aligns your portfolio with your specific needs, whether it’s aggressive growth in your 20s or income generation in your 50s.

Different Asset Classes and Their Behavior

Understanding the behavior of different asset classes is crucial for effective asset allocation. Here’s an overview:

- Stocks (Equities): Offer potentially high returns but come with higher volatility. Suitable for growth-oriented investors.

- Bonds (Fixed-Income Securities): Provide regular income and are generally less volatile than stocks. Ideal for stability and income generation.

- Cash and Cash Equivalents: Include money market funds and Treasury bills. Offer liquidity and safety but lower returns.

- Real Estate: Can provide diversification, income from rent, and potential appreciation.

- Commodities: Include gold, oil, and agricultural products. Can offer diversification and act as a hedge against inflation.

Age-Specific Recommendations

Asset allocation should evolve with age, reflecting changing risk tolerance and financial goals. Here’s a general guideline:

- In Your 20s: Focus on growth, with a higher allocation to stocks (e.g., 80-90% stocks, 10-20% bonds).

- In Your 50s: Shift towards stability, with a more balanced allocation (e.g., 50-60% stocks, 40-50% bonds).

- In Retirement: Emphasize income and capital preservation, with a conservative mix (e.g., 30-50% stocks, 50-70% bonds).

Asset allocation is both an art and a science, requiring a deep understanding of different asset classes, risk management, and personal financial goals. It’s a dynamic process that should be regularly reviewed and adjusted as life circumstances, market conditions, and financial objectives change. By mastering the concept of asset allocation, you can create a resilient and well-tailored investment portfolio that serves you well at any stage of life.

The Impact of Life Stages on Investment

Investment strategies are not static; they evolve with different life stages, reflecting changing priorities, financial goals, and risk tolerance. From career-focused investment in your 30s to post-retirement considerations in your 70s and 80s, each stage brings unique opportunities and challenges. Let’s explore how investment strategies shift across these critical life stages.

Career-Focused Investment in 30s

Your 30s are often marked by career growth, family commitments, and long-term financial planning. Here’s how investment strategies align:

- Growth and Stability: Balancing aggressive growth with stability, focusing on a mix of growth stocks, dividend-paying stocks, and bonds.

- Homeownership and Education: Investing in real estate or saving for children’s education through vehicles like 529 plans.

- Retirement Planning: Continuing contributions to retirement accounts, leveraging employer benefits, and considering long-term tax strategies.

Retirement-Minded Investment in 40s

As you enter your 40s, retirement planning takes center stage, and investment strategies become more nuanced. Here’s what to consider:

- Asset Reallocation: Gradually shifting towards a more conservative asset mix, reducing exposure to high-risk investments.

- Retirement Milestones: Assessing retirement goals, timelines, and required savings, adjusting contributions and investment strategies accordingly.

- Estate and Legacy Planning: Initiating estate planning, considering wills, trusts, and ensuring a smooth financial transition for heirs.

Post-Retirement Investment in 70s and 80s

Post-retirement investment focuses on income generation, capital preservation, and legacy planning. Here’s how to approach it:

- Income Focus: Investing in income-generating assets like bonds, annuities, or dividend-paying stocks to support living expenses.

- Healthcare and Long-Term Care: Considering investments or insurance to cover potential healthcare and long-term care expenses.

- Philanthropy and Legacy: Exploring charitable giving, setting up trusts, or other legacy planning to support causes or leave a financial legacy.

Investing is a lifelong journey that evolves with each life stage. From the career-driven focus of your 30s to the retirement planning of your 40s and the post-retirement considerations of your 70s and 80s, each stage requires tailored investment strategies. By understanding the unique financial needs, opportunities, and challenges of each life stage, you can create a dynamic and responsive investment plan that supports your goals, values, and aspirations at every step of the way.

Common Mistakes and How to Avoid Them

Investing is a complex and nuanced endeavor, and even seasoned investors can fall into common traps. Recognizing and avoiding these mistakes can make a significant difference in your financial success. Let’s explore some of the common mistakes and how to steer clear of them.

Investing Too Late or Too Conservatively in 20s

In your 20s, time is your greatest asset, and failing to leverage it can be a costly mistake. Investing too late or too conservatively during this stage can hinder your long-term growth potential.

How to Avoid: Embrace the opportunity to take calculated risks. Consider growth-oriented investments like stocks or emerging markets. Don’t shy away from investing because of perceived lack of funds or fear of the unknown. Even small contributions can grow substantially over time, thanks to compound interest. Educate yourself, seek professional guidance if needed, and start investing early to maximize your financial potential.

Taking Unnecessary Risks in 50s

While risk-taking might be suitable in your 20s, taking unnecessary or ill-considered risks in your 50s can jeopardize your retirement savings.

How to Avoid: As you approach retirement, shift your focus towards stability and capital preservation. Gradually reduce exposure to high-risk investments and focus on a balanced, diversified portfolio that aligns with your retirement goals. Regularly reassess your investment strategy, considering your risk tolerance, financial needs, and market conditions. If in doubt, seek professional advice to ensure your investment approach is aligned with your stage of life.

Lack of Diversification and Professional Guidance

Putting all your eggs in one basket or failing to seek professional guidance can lead to significant financial setbacks. Lack of diversification exposes you to unnecessary risk, while lack of professional guidance can result in missed opportunities or costly mistakes.

How to Avoid: Diversification is key to risk management. Spread your investments across different asset classes, sectors, and regions to create a resilient portfolio. Don’t hesitate to seek professional advice, especially during critical life stages or complex financial decisions. Financial advisors can provide personalized insights, tax planning, retirement strategies, and more, helping you navigate the complex world of investing with confidence.

Investing is as much about wisdom and foresight as it is about numbers and analysis. Recognizing common mistakes and knowing how to avoid them can set you on a path to financial success. Whether it’s embracing risk in your 20s, seeking stability in your 50s, or ensuring diversification and professional guidance, each decision shapes your financial journey. By learning from these common pitfalls and applying the insights shared, you can invest with greater confidence, clarity, and success, no matter your age or life stage.

The Future of Investing: Technology and Automation

The investment landscape is undergoing a profound transformation, driven by technological advancements and automation. From FinTech innovations to automated investing platforms, technology is reshaping how we invest, offering new opportunities and efficiencies. Let’s explore this exciting frontier and how it can benefit investors of all ages.

Introduction to FinTech and Automated Investing

Financial Technology, or FinTech, refers to the integration of technology into financial services, enhancing accessibility, efficiency, and user experience. Automated investing, a subset of FinTech, leverages algorithms and artificial intelligence to manage investment portfolios, often with minimal human intervention.

- Robo-Advisors: These platforms use algorithms to create and manage personalized investment portfolios based on an individual’s risk tolerance, goals, and preferences.

- Algorithmic Trading: Sophisticated algorithms analyze market trends and execute trades at optimal times, often outpacing human traders.

- Blockchain and Cryptocurrencies: Emerging technologies like blockchain are revolutionizing asset management, while cryptocurrencies offer new investment opportunities.

How Technology Can Aid Different Age Groups

Technology’s impact on investing transcends age, offering unique benefits to different life stages:

- Young Investors: For those in their 20s and 30s, technology offers accessibility and affordability. Robo-advisors and investment apps make it easier to start investing with lower fees and minimums. Gamified platforms can make learning about investing engaging and fun.

- Mid-Life Investors: In the 40s and 50s, technology can streamline retirement planning, tax optimization, and portfolio management. Advanced tools offer insights into asset allocation, risk assessment, and long-term financial planning.

- Retired Investors: For those in retirement, technology offers convenience and control. Online platforms provide easy access to account information, income management, and estate planning tools. Automated alerts and updates can help retirees stay informed and make timely financial decisions.

Conclusion

Investing is a multifaceted journey that evolves with each life stage, reflecting individual goals, risk tolerance, and financial aspirations. From the importance of starting early to the nuances of asset allocation, common mistakes to avoid, and the exciting future shaped by technology, the principles of wise investing guide us through the complexities of financial decision-making. Embracing growth opportunities, seeking professional guidance, and leveraging technological innovations are key to securing a financial future that aligns with our dreams and values.

Personalized financial planning, tailored to individual needs, goals, and life stages, is a pathway to success. Whether just starting or well on the way, the time to invest wisely is now. The future of investing is bright, and the opportunities are boundless. Let’s embrace this journey with confidence and wisdom, knowing that the future is ours to shape.

At bitvestment.software, our commitment is to deliver unbiased and reliable information on subjects like cryptocurrency, finance, trading, and stocks. It's crucial to understand that we are not equipped to offer financial advice, and we actively encourage users to conduct their own comprehensive research.

Read More