The digital age has ushered in a plethora of innovations, among which cryptocurrency stands out as a particularly disruptive and transformative force. As with any significant technological advancement, it’s essential to understand not just its functional attributes but also its broader societal implications. This introduction aims to set the stage for a comprehensive exploration of the ethical dimensions of cryptocurrency.

The Rise of Cryptocurrencies

Cryptocurrencies, at their core, are digital or virtual currencies that use cryptography for security, making them resistant to counterfeiting. The pioneer and most well-known cryptocurrency is Bitcoin, introduced in 2009 by an anonymous entity known as Satoshi Nakamoto. Since then, thousands of alternative cryptocurrencies have emerged, each with its unique features and purposes.

Table 1.1: Evolution of Major Cryptocurrencies Over Time

| Year | Cryptocurrency | Notable Feature |

|---|---|---|

| 2009 | Bitcoin (BTC) | First decentralized cryptocurrency |

| 2011 | Litecoin (LTC) | Faster transaction times than Bitcoin |

| 2015 | Ethereum (ETH) | Introduced smart contracts |

| 2017 | Ripple (XRP) | Digital payment protocol more than a cryptocurrency |

| 2020 | Chainlink (LINK) | Connects smart contracts with real-world data |

The Need for Ethical Understanding

While the technical intricacies of cryptocurrencies are fascinating, it’s their potential societal impact that warrants deep ethical scrutiny. As digital currencies become more integrated into our global financial systems, questions about their influence on economic structures, individual behaviors, and societal norms become increasingly pertinent.

For instance, consider the following scenarios:

- Decentralization vs. Regulation: Cryptocurrencies operate in a decentralized manner, often outside the purview of traditional banking systems and governmental oversight. While this offers enhanced privacy and reduced transaction costs, it also poses challenges for regulatory frameworks and raises concerns about potential misuse.

- Financial Inclusion vs. Market Volatility: Cryptocurrencies can offer financial inclusion to those without access to traditional banking. However, the volatile nature of cryptocurrency markets can pose significant financial risks.

Setting the Stage for Exploration

This article aims to delve deep into the ethical side of cryptocurrency, examining its potential benefits and pitfalls. By understanding its social impact, we can better navigate the challenges and opportunities presented by this digital revolution.

In the subsequent sections, we will explore the ethical upsides and potential downsides of cryptocurrencies, their role in tax evasion, their use in nefarious activities, and the ethical frameworks that can be applied to understand them better.

The Ethical Upsides of Cryptocurrencies

Cryptocurrencies, despite the controversies surrounding them, have brought about several positive changes and possibilities. These upsides are not just technological but also ethical, offering new avenues for financial freedom, transparency, and inclusivity.

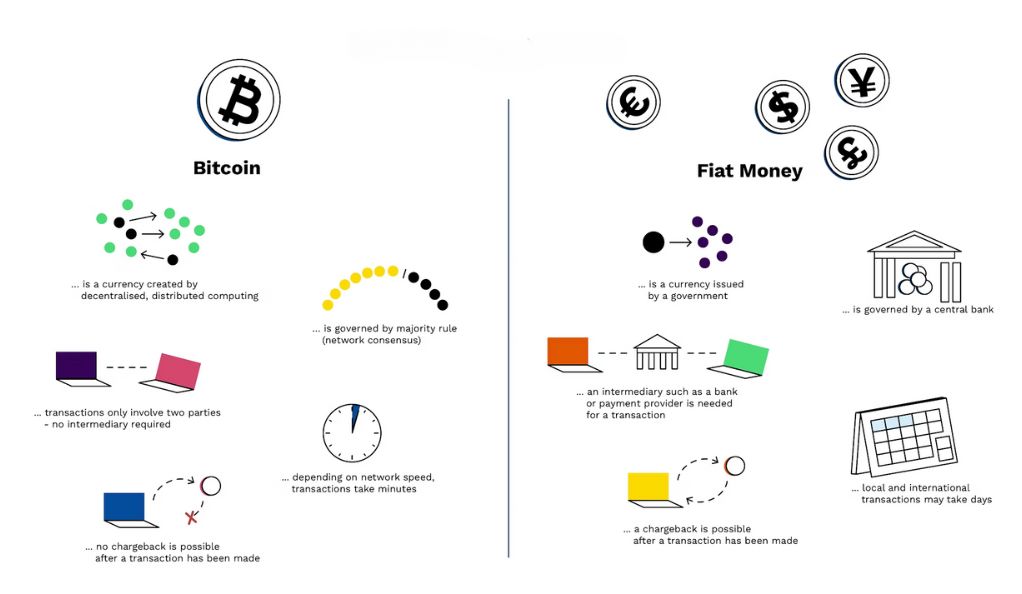

Cryptocurrencies vs. Central Bank Fiat Money

One of the most significant advantages of cryptocurrencies is their decentralized nature. Unlike traditional fiat currencies, which are regulated and controlled by central banks, cryptocurrencies operate on decentralized platforms.

Table 2.1: Comparison between Cryptocurrencies and Central Bank Fiat Money

| Features | Cryptocurrencies | Central Bank Fiat Money |

|---|---|---|

| Control | Decentralized, often governed by consensus mechanisms | Centralized, regulated by governments and central banks |

| Supply | Typically predetermined (e.g., Bitcoin’s 21 million cap) | Can be changed based on economic policies |

| Anonymity | High (though not absolute) | Low, especially with large transactions |

| Transaction Speed | Can vary, but generally faster and global | Slower, especially for international transactions |

| Accessibility | Anyone with internet access can participate | Requires access to banking infrastructure |

Fostering a More Future-Oriented Society

Cryptocurrencies, by design, often have a capped supply, which can encourage saving and long-term planning. For instance, Bitcoin’s maximum supply is capped at 21 million coins. This scarcity can potentially lead to a more future-oriented society, where individuals are incentivized to think long-term rather than seeking immediate gratification.

Prevention of Massive Redistributions through Money Production

Central banks have the authority to print money, leading to inflation. While inflation is sometimes necessary for economic reasons, it can also result in the devaluation of savings, especially for those in lower economic strata. Cryptocurrencies, with their capped supplies, can prevent such massive redistributions of wealth, ensuring that the value of one’s savings isn’t eroded over time.

Financial Inclusion

One of the most profound ethical upsides of cryptocurrencies is the potential for financial inclusion. Billions of people worldwide lack access to traditional banking systems. Cryptocurrencies can bridge this gap, allowing anyone with an internet connection to participate in the global economy, send and receive money, and access financial services.

The Potential Ethical Downsides

While cryptocurrencies present numerous advantages, they are not without their ethical concerns. These concerns range from their potential to facilitate illicit activities to the environmental impact of their underlying technologies.

The Challenges of Price Volatility

One of the most significant challenges associated with cryptocurrencies is their price volatility. The value of a cryptocurrency can fluctuate dramatically within short periods, leading to substantial financial gains or losses for investors and users.

Table 3.1: Major Cryptocurrency Price Fluctuations

| Cryptocurrency | Date | Price Change | Possible Cause |

|---|---|---|---|

| Bitcoin (BTC) | Dec 2017 | Reached nearly $20,000, only to drop to around $6,000 by Feb 2018 | Speculative trading, regulatory news |

| Ethereum (ETH) | Jan 2018 | Peaked at around $1,400, then declined to $400 by April 2018 | Market correction, ICO sell-offs |

| Ripple (XRP) | Jan 2018 | Reached $3.84, dropping to $0.58 by March 2018 | Market sentiment, broader crypto trends |

Such volatility can be problematic for those who use cryptocurrencies as a medium of exchange or a store of value. It also raises ethical concerns about the potential for market manipulation and the impact on inexperienced investors.

The Debate on Deflation

Given the capped supply of many cryptocurrencies, there’s a debate about their potential deflationary nature. Deflation, or the reduction in the general level of prices, can lead to decreased consumer spending as people wait for prices to drop further. This can potentially stall economic growth and lead to recessions.

Cryptocurrencies and Environmental Concerns

The process of mining certain cryptocurrencies, especially Bitcoin, requires significant computational power. This has led to concerns about the environmental impact of cryptocurrency mining, given the vast amounts of electricity it consumes.

Table 3.2: Estimated Energy Consumption of Major Cryptocurrencies

| Cryptocurrency | Estimated Annual Energy Consumption (TWh) |

|---|---|

| Bitcoin (BTC) | 120.1 TWh (Comparable to Argentina) |

| Ethereum (ETH) | 44.3 TWh (Comparable to New Zealand) |

The environmental implications raise ethical questions about the sustainability of cryptocurrencies, especially in the context of global efforts to combat climate change.

Potential for Illicit Activities

The pseudonymous nature of cryptocurrency transactions can make them attractive for illicit activities, such as money laundering, tax evasion, and illegal trade. While the majority of cryptocurrency users engage in legitimate transactions, the potential for misuse cannot be ignored.

Cryptocurrencies and Tax Evasion

The decentralized and pseudonymous nature of cryptocurrencies has raised concerns about their potential use in evading taxes. While the majority of cryptocurrency users and investors comply with tax regulations, the very structure of these digital assets provides avenues that can be exploited for tax evasion.

The Morality of Tax Evasion

Before delving into the mechanics, it’s crucial to understand the ethical implications of tax evasion. Taxes are a primary source of revenue for governments, funding public services like healthcare, education, and infrastructure. Evading taxes can be seen as depriving society of essential resources, leading to debates about the morality of such actions, especially when facilitated by new technologies like cryptocurrencies.

How Cryptocurrencies Can Facilitate Tax Evasion

Several features of cryptocurrencies make them conducive to tax evasion:

- Pseudonymity: While cryptocurrency transactions are recorded on public ledgers, they are linked to digital addresses, not personal identities. This can make tracing transactions to individuals challenging.

- Decentralization: Without a central authority overseeing transactions, it becomes difficult for tax authorities to monitor and verify cryptocurrency trades and holdings.

- Cross-border Transactions: Cryptocurrencies can be sent and received anywhere globally, often bypassing traditional banking systems and controls.

The Social Contract Theory and Taxation

The social contract theory posits that individuals consent, either explicitly or tacitly, to surrender some of their freedoms to a governing body in exchange for protection of their remaining rights. Taxes can be viewed as part of this contract, where citizens agree to contribute a portion of their income for the greater good. Cryptocurrencies challenge this traditional view, offering a decentralized alternative to the established financial system.

Regulatory Responses to Cryptocurrency Tax Evasion

Recognizing the potential challenges posed by cryptocurrencies, many governments have started implementing regulatory measures:

- Disclosure Requirements: Some jurisdictions now require cryptocurrency holders to disclose their holdings, transactions, and capital gains for tax purposes.

- Collaboration: International collaborations, like the Joint Chiefs of Global Tax Enforcement (J5), aim to combat tax evasion and money laundering through cryptocurrencies.

- Educational Campaigns: Tax authorities in various countries have initiated campaigns to educate the public about their tax obligations related to cryptocurrencies.

Cryptocurrencies and Nefarious Consumption

Cryptocurrencies, with their promise of privacy and decentralization, have unfortunately also become a tool for various illicit activities. This section delves into the darker side of cryptocurrency usage, exploring its association with the black market, illegal transactions, and other nefarious activities.

The Allure of Anonymity

The primary attraction for illicit actors towards cryptocurrencies is the degree of anonymity they offer. While not entirely anonymous, cryptocurrencies like Bitcoin offer a level of pseudonymity where transactions are tied to digital wallet addresses rather than personal identities. More privacy-focused coins, such as Monero and Zcash, offer enhanced anonymity features, making transactions virtually untraceable.

Cryptocurrencies in the Black Market

The black market, which operates outside the regulated economy, was one of the early adopters of cryptocurrencies. Platforms like the infamous Silk Road used Bitcoin as a primary mode of transaction for illegal drugs, weapons, and other contraband.

Table 5.1: Notable Black Market Platforms and Their Association with Cryptocurrencies

| Platform | Operational Years | Primary Cryptocurrency Used |

|---|---|---|

| Silk Road | 2011-2013 | Bitcoin |

| AlphaBay | 2014-2017 | Bitcoin, Monero, Ethereum |

| Dream Market | 2013-2019 | Bitcoin, Bitcoin Cash, Monero |

Ransomware and Digital Extortion

Ransomware attacks, where hackers encrypt a victim’s data and demand payment for its release, have seen a surge in recent years. Cryptocurrencies, primarily Bitcoin, have become the preferred mode of ransom payment due to their pseudonymous nature, making it challenging for authorities to trace and apprehend the culprits.

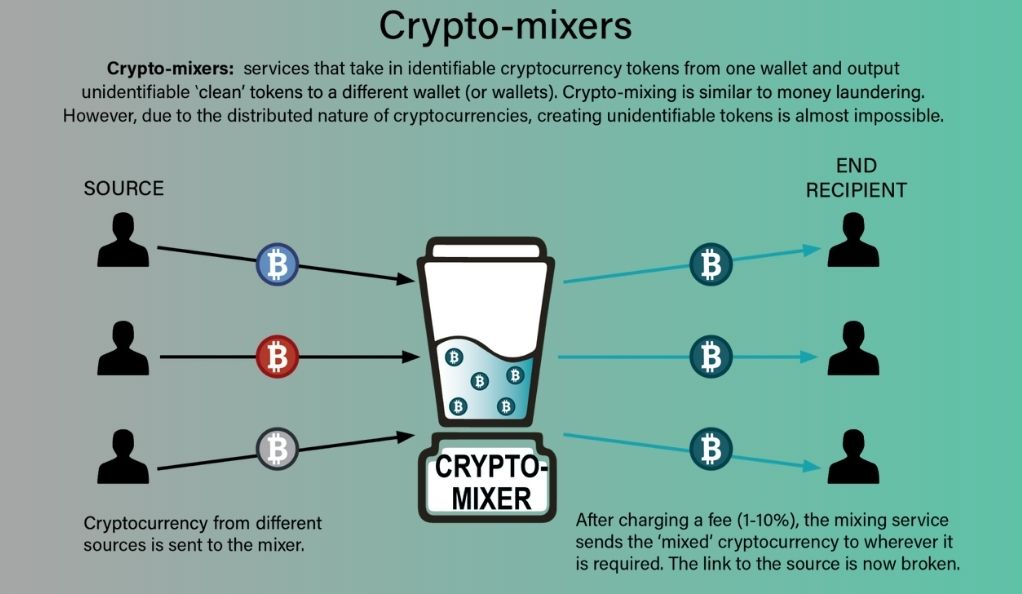

Money Laundering and Cryptocurrencies

Money laundering, the process of making illegally-gained proceeds appear legal, has found a new avenue with cryptocurrencies. By moving funds through various cryptocurrency wallets, exchanges, and even using ‘mixing’ services, illicit actors can obscure the origins of their funds.

Addressing the Challenges: The Role of Regulation and Technology

While cryptocurrencies have been exploited for nefarious purposes, solutions are emerging to address these challenges:

- Regulatory Oversight: Many countries are implementing Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations for cryptocurrency exchanges to curb illicit activities.

- Advanced Analytics: Blockchain analysis companies are developing tools to trace cryptocurrency transactions, helping law enforcement agencies track illicit activities.

- Community Vigilance: The broader cryptocurrency community plays a crucial role in identifying and reporting suspicious activities, ensuring that the ecosystem remains transparent and secure.

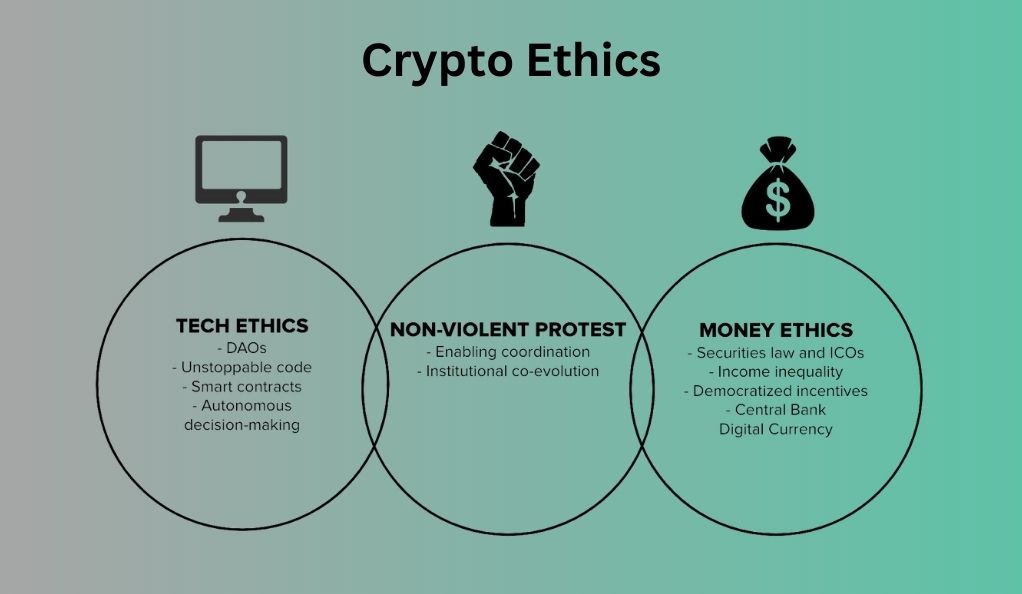

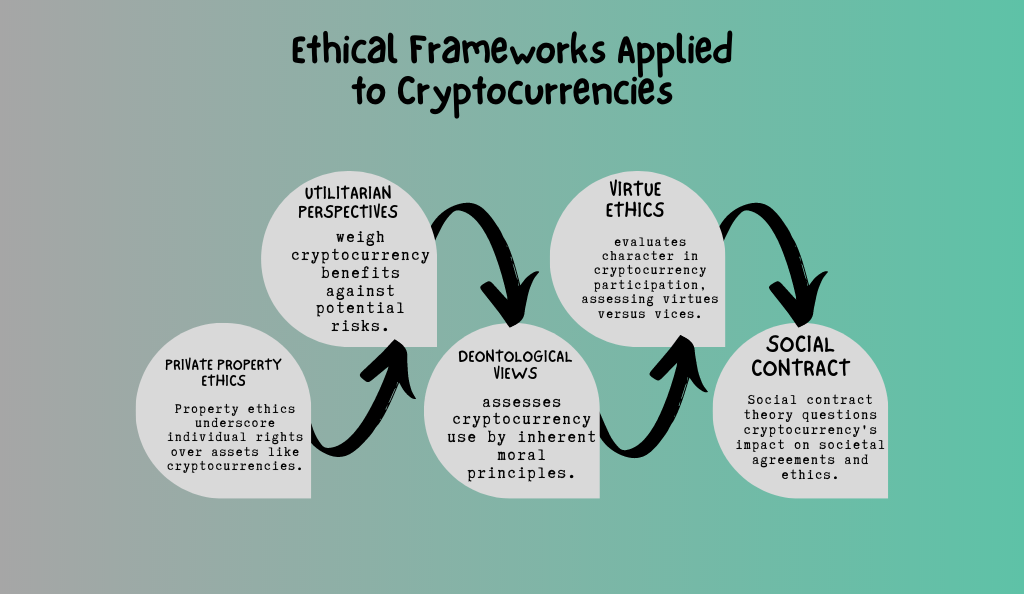

The Ethical Frameworks Applied to Cryptocurrencies

To truly grasp the ethical dimensions of cryptocurrencies, it’s essential to view them through various ethical frameworks. These frameworks provide structured ways to evaluate the moral implications of actions, decisions, and innovations like cryptocurrencies.

Private Property Ethics and Cryptocurrencies

Private property ethics emphasize the moral rights of individuals to acquire, control, use, and transfer property. Cryptocurrencies, being digital assets, fall within this purview. They empower individuals with full control over their digital wealth, free from government intervention or bank oversight. However, this also means individuals bear full responsibility for their assets, raising questions about the ethical implications of potential thefts or losses.

Utilitarian Perspectives on Cryptocurrencies

The utilitarian ethical framework evaluates actions based on their outcomes, emphasizing the greatest good for the greatest number. From this perspective, the benefits of cryptocurrencies, such as financial inclusion and reduced transaction costs, are weighed against their potential downsides, like facilitating illicit activities or market volatility. The challenge lies in quantifying these pros and cons to arrive at a comprehensive ethical assessment.

Deontological Views on Cryptocurrencies

Deontological ethics focuses on the inherent morality of actions, regardless of their outcomes. From this standpoint, the use of cryptocurrencies can be evaluated based on principles like honesty, fairness, and rights. For instance, is it morally right to use cryptocurrencies if they undermine a country’s economic policies or facilitate tax evasion?

Virtue Ethics and Cryptocurrencies

Virtue ethics emphasizes the character of the moral agent rather than the moral act itself. In the context of cryptocurrencies, it prompts introspection about the virtues or vices being cultivated by participating in the crypto ecosystem. Are users cultivating virtues like prudence and responsibility, or are they succumbing to vices like greed and recklessness?

Social Contract Theory Revisited

As discussed earlier, the social contract theory posits a tacit agreement between individuals and society. Cryptocurrencies challenge this traditional contract, especially in areas like taxation and regulation. The ethical question then becomes: Are individuals using cryptocurrencies upholding their end of the social contract, or are they undermining the very foundations of societal agreements?

The Future Implications of Cryptocurrency Adoption

As cryptocurrencies continue to gain traction, it’s crucial to look ahead and consider the potential long-term implications of their widespread adoption. These implications span economic, social, and political domains, reshaping the very fabric of society in ways we are only beginning to understand.

Reshaping Economic Structures

The decentralized nature of cryptocurrencies challenges traditional economic structures, particularly the role of central banks and financial institutions. As more people adopt cryptocurrencies:

- Decentralized Finance (DeFi): Traditional banking functions, such as lending, borrowing, and earning interest, are being replicated in the decentralized world through DeFi platforms, reducing the need for intermediaries.

- Monetary Policy: Central banks may find it challenging to implement monetary policies effectively if a significant portion of the economy operates outside their purview.

Societal Norms and Values

The ethos of cryptocurrencies, emphasizing privacy, autonomy, and decentralization, might influence societal values. We could see a shift towards:

- Greater Emphasis on Privacy: As people become accustomed to the privacy features of cryptocurrencies, they might demand similar privacy standards in other digital interactions.

- Decentralized Governance: The principles of decentralized consensus, as seen in many cryptocurrencies, could inspire new forms of governance, emphasizing community-driven decision-making.

Governments and Cryptocurrencies: A Complex Dance

Governments worldwide are grappling with the rise of digital currencies:

- Regulation: Striking a balance between fostering innovation and ensuring consumer protection remains a challenge.

- Central Bank Digital Currencies (CBDCs): Many countries are exploring the idea of launching their digital currencies, merging the benefits of cryptocurrencies with the stability and trust of central bank backing.

Environmental Considerations

As mentioned earlier, the environmental impact of some cryptocurrency mining operations is significant. The future might see:

- Greener Alternatives: A shift towards more energy-efficient consensus mechanisms, like Proof of Stake (PoS), as opposed to the energy-intensive Proof of Work (PoW) used by Bitcoin.

- Carbon Neutral Mining: Initiatives to offset the carbon footprint of cryptocurrency mining, either through renewable energy sources or carbon credits.

The Ethical Evolution

As cryptocurrencies become more mainstream, the ethical debates surrounding them will evolve. The community, regulators, and users will need to continuously reassess the ethical dimensions of cryptocurrencies, adapting to new challenges and opportunities.

Conclusion

The world of cryptocurrencies stands as a testament to the power of innovation, challenging traditional paradigms and offering a glimpse into a future where finance, technology, and ethics intertwine. From their humble beginnings as a niche digital currency to their current status as a formidable force in the global financial landscape, cryptocurrencies have sparked debates, inspired change, and raised crucial ethical questions.

As we’ve journeyed through the multifaceted dimensions of cryptocurrencies, from their undeniable benefits to their potential pitfalls, one thing becomes clear: the crypto revolution is not just about technology; it’s about people, society, and the moral choices we make. The decentralized ethos of cryptocurrencies empowers individuals, but with this power comes responsibility. Responsibility to understand, to adapt, and to ensure that the digital realm of finance serves the greater good.

The challenges are many, from regulatory hurdles to environmental concerns, but so are the opportunities. Opportunities for financial inclusion, for a more transparent and equitable financial system, and for a society that values privacy and autonomy.

In the end, cryptocurrencies are not just a technological phenomenon; they are a reflection of our values, aspirations, and the kind of future we envision. As we stand at this crossroads, it’s essential to approach the world of digital currencies with an open mind, a critical eye, and a commitment to ethical reflection and action. Only then can we harness the full potential of cryptocurrencies and pave the way for a brighter, more inclusive financial future.

At bitvestment.software, our commitment is to deliver unbiased and reliable information on subjects like cryptocurrency, finance, trading, and stocks. It's crucial to understand that we are not equipped to offer financial advice, and we actively encourage users to conduct their own comprehensive research.

Read More