Introduction

In today’s fast-paced world, the realm of investments is not just reserved for financial experts or Wall Street aficionados. From young professionals to retirees, understanding the basics of investments has become imperative for financial security and growth. As we delve into this introductory section, we’ll explore the ever-changing investment landscape and underscore the significance of grasping foundational principles.

The Dynamic Investment Landscape

The investment world is akin to a vast ocean, teeming with a myriad of opportunities, risks, and rewards. Over the past few decades, this landscape has witnessed monumental shifts:

- Globalization: With the advent of technology and the internet, global markets have become more interconnected than ever. An event in one part of the world can ripple across continents, affecting stock prices, interest rates, and currency values.

- Technological Advancements: The rise of fintech has democratized access to investment tools and platforms. Today, with a smartphone and an app, anyone can start investing, track their portfolio, or even get AI-driven financial advice.

- Diverse Investment Vehicles: From traditional stocks and bonds to modern-day cryptocurrencies and peer-to-peer lending, the array of investment options has expanded exponentially.

| Traditional Investments | Modern-Day Investments |

|---|---|

| Stocks | Cryptocurrencies |

| Bonds | Peer-to-peer lending |

| Mutual Funds | Robo-advisors |

| Real Estate | Crowdfunding platforms |

Grasping the Foundational Principles

Understanding the basic principles of investing is not just about recognizing various investment vehicles or tracking market trends. It’s about cultivating a mindset, a discipline that guides you in making informed decisions. Here are some foundational tenets every budding investor should internalize:

- Risk and Reward: At the heart of every investment decision is the balance between risk and reward. Typically, higher potential returns come with increased risks. It’s crucial to assess your risk tolerance and align it with your investment choices.

- Diversification: “Don’t put all your eggs in one basket.” This age-old adage holds true in the investment world. Spreading your investments across different asset classes can help mitigate risks.

- Long-term Perspective: While it’s tempting to chase short-term gains, especially in a volatile market, successful investing often requires patience and a long-term perspective.

- Continuous Learning: The investment landscape is ever-evolving. Regularly updating your knowledge, staying abreast of global events, and adapting to market changes are essential for investment success.

The Investment Risk Ladder

Navigating the world of investments is akin to climbing a ladder. Each rung represents a different level of risk, and as you ascend, the potential for both reward and loss can increase. Understanding this metaphorical ladder is crucial for any investor, as it helps in making informed decisions that align with one’s financial goals and risk tolerance.

Understanding the Concept of Risk

At its core, risk in investments refers to the uncertainty of returns. It’s the potential that the actual return on an investment might differ from the expected return. This uncertainty can arise from various factors, including market volatility, economic changes, geopolitical events, and even company-specific issues.

There are two primary types of risks to consider:

- Systematic Risk (Undiversifiable Risk): This type of risk affects the entire market or a broad segment of it. Factors such as inflation rates, political instability, or changes in interest rates can lead to systematic risk. Since it affects the entire market, it’s nearly impossible to protect against this risk through diversification.

- Unsystematic Risk (Diversifiable Risk): This risk is specific to a particular company or industry. Factors like company management, production processes, or consumer demand can influence unsystematic risk. Investors can mitigate this risk by diversifying their portfolio across various industries or sectors.

Differentiating Investments Based on Risk

As we climb the investment risk ladder, we encounter various investment vehicles, each with its unique risk profile. Here’s a breakdown:

- Cash and Cash Equivalents: These are the lowest rung on the risk ladder. Examples include savings accounts, money market funds, and certificates of deposit (CDs). While they offer stability and liquidity, their returns are typically lower than other investment vehicles.

- Bonds: A step higher on the ladder, bonds are debt instruments where you lend money to an entity (like a government or corporation) in exchange for periodic interest payments. While generally safer than stocks, they can be affected by interest rate changes.

- Stocks: Representing ownership in a company, stocks come with higher potential returns but also higher volatility. Their performance is tied to the company’s success and broader market trends.

- Mutual Funds: These pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. The risk varies based on the assets included in the fund.

- Real Estate: Investing in physical properties or real estate investment trusts (REITs) can offer lucrative returns but comes with risks like property market fluctuations and maintenance issues.

- Alternative Investments: This category includes hedge funds, private equity, and commodities. They can offer high returns but come with increased complexity and risk.

- Cryptocurrencies: A relatively new entrant, cryptocurrencies like Bitcoin and Ethereum are known for their extreme volatility. While they offer significant return potential, they’re also subject to regulatory and security concerns.

Cash as an Investment

In the intricate tapestry of investment options, cash stands out as the most fundamental and straightforward form. Often overlooked in the pursuit of higher returns, cash investments, such as savings accounts and certificates of deposit (CDs), play a pivotal role in a well-rounded portfolio.

Understanding Cash Investments

Cash investments refer to putting your money into financial products or accounts that preserve the capital and offer a modest return. Unlike volatile stocks or complex derivatives, cash investments are straightforward. You deposit money, it earns interest, and you can access it when needed.

The most common cash investments include:

- Savings Accounts: Offered by banks and credit unions, these accounts provide a safe place to store money while earning interest. They are highly liquid, meaning you can withdraw your funds at any time.

- Certificates of Deposit (CDs): These are time deposits with banks or credit unions. In exchange for depositing your money for a fixed period (ranging from a few months to several years), you receive a predetermined interest rate. Once the term ends, you get back your principal amount along with the accrued interest.

Pros

- Safety: One of the primary advantages of cash investments is the safety of the principal amount. Especially in insured accounts, your money is protected up to a certain limit, even if the bank or credit union faces financial difficulties.

- Liquidity: With savings accounts, you can access your money whenever you need it, making it an excellent option for emergency funds.

- Predictability: The interest rates for savings accounts and CDs are usually fixed, allowing you to know in advance the returns you’ll earn.

- No Entry Barrier: Unlike some investment options that require significant initial amounts, you can start a savings account or CD with a minimal deposit.

Cons

- Lower Returns: Compared to stocks, bonds, or real estate, cash investments typically offer much lower returns. Over time, the value of your money might not keep up with inflation, leading to a decrease in purchasing power.

- Penalties on CDs: While CDs might offer higher interest rates than savings accounts, they come with a catch. Withdrawing your money before the term ends can result in penalties, reducing your overall returns.

- Interest Rate Fluctuations: The interest rates on savings accounts can change based on the economic environment. In a low-interest-rate scenario, the returns on cash investments can be minimal.

- Opportunity Cost: By keeping a significant portion of your funds in cash investments, you might miss out on potentially higher returns from other investment opportunities.

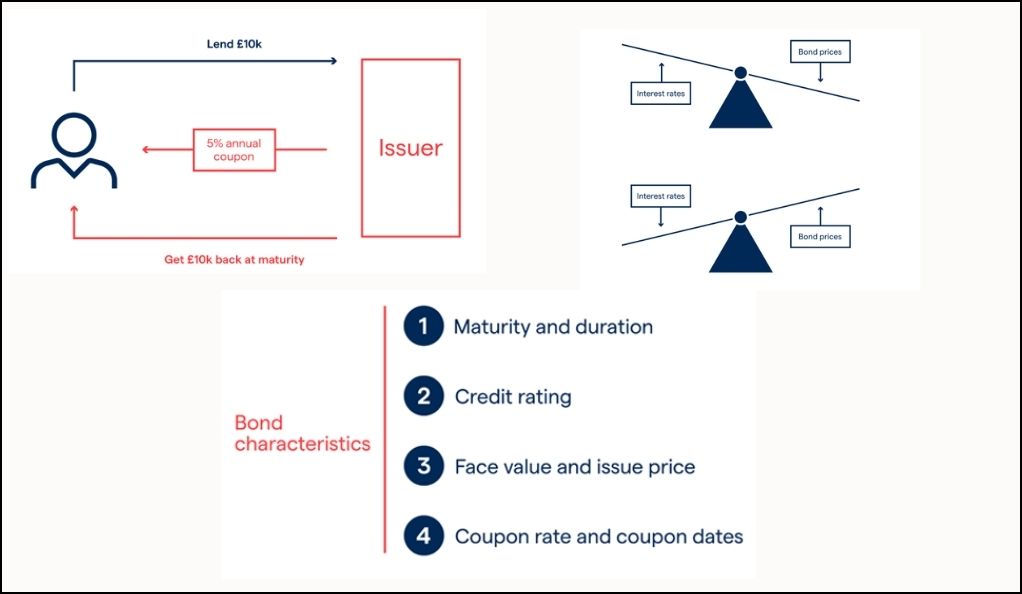

Bonds: Lending Your Money

In the vast universe of investment options, bonds stand as a testament to the age-old principle of lending and borrowing. They represent a formal contract between the lender (investor) and the borrower (issuer), promising the return of the principal amount along with interest. Let’s delve deeper into the world of bonds, understanding their mechanics and the intricate relationship they share with interest rates.

What are Bonds?

Bonds are debt securities, akin to IOUs. When you purchase a bond, you are essentially lending money to the issuer, which could be a government, municipality, corporation, or other entities. In return for this loan, the issuer promises to pay you periodic interest payments and return the bond’s face value when it matures.

The main components of a bond include:

- Face Value (or Par Value): This is the amount the bond will be worth at maturity. It’s the principal amount that the issuer borrows and promises to repay the bondholder.

- Coupon Rate: This is the interest rate that the bond issuer agrees to pay the bondholder. It’s usually expressed as a percentage of the face value.

- Maturity Date: The date on which the bond will mature, and the issuer will repay the bond’s face value to the bondholder.

- Issuer: The entity that issues the bond, borrows the money, and pays interest to the bondholder.

The Relationship Between Bonds and Interest Rates

Bonds and interest rates share an inverse relationship. When interest rates rise, bond prices fall, and vice versa. Here’s why:

- Existing Bonds vs. New Bonds: Imagine you hold a bond that pays a 3% coupon rate. If interest rates rise and new bonds are issued at a 4% coupon rate, your bond becomes less attractive to potential buyers because they can get a higher interest rate with new bonds. Consequently, the price of your bond will drop to make it competitive in the market.

- Discount and Premium: Bonds selling at a price below their face value are said to be at a “discount,” while those selling above face value are at a “premium.” When interest rates rise, existing bonds typically sell at a discount. Conversely, when rates fall, they often sell at a premium.

- Reinvestment Risk: When interest rates fall, bondholders face the risk of having to reinvest their periodic interest payments (or the bond’s face value upon maturity) at a lower rate than the bond’s original coupon rate.

- Duration: Duration measures a bond’s sensitivity to interest rate changes. Bonds with longer durations are more sensitive to interest rate fluctuations than those with shorter durations. Thus, a long-term bond might see more significant price changes in response to interest rate shifts than a short-term bond.

Diving into Mutual Funds

In the vast mosaic of investment avenues, mutual funds have emerged as a popular and accessible choice for many. They offer a unique blend of diversification, professional management, and scalability. Whether you’re a novice investor or a seasoned financial enthusiast, understanding mutual funds can provide a robust foundation for your investment journey.

Pooling Money for Diversified Investments

At its core, a mutual fund is a collective investment vehicle. It pools money from multiple investors to invest in a diversified portfolio of assets, which can include stocks, bonds, money market instruments, or other securities.

How does it work?

- Investment Objective: Each mutual fund has a specific investment objective, clearly outlined in its prospectus. This objective guides the fund’s investment strategy and asset allocation.

- Fund Manager: The pooled funds are managed by a professional fund manager or a team of managers. They make investment decisions based on research, market analysis, and the fund’s stated objective.

- Units and Net Asset Value (NAV): When you invest in a mutual fund, you receive ‘units’ proportional to your investment amount. The value of these units, expressed as NAV, fluctuates based on the total value of the fund’s underlying assets.

- Diversification: One of the primary advantages of mutual funds is diversification. Instead of investing in a single stock or bond, mutual funds spread the investment across multiple assets, reducing the risk associated with individual securities.

Active vs. Passive Mutual Funds

The mutual fund universe is broadly divided into two categories based on their management style: active and passive.

Diving into Mutual Funds

In the vast mosaic of investment avenues, mutual funds have emerged as a popular and accessible choice for many. They offer a unique blend of diversification, professional management, and scalability. Whether you’re a novice investor or a seasoned financial enthusiast, understanding mutual funds can provide a robust foundation for your investment journey. Let’s dive deep into the world of mutual funds, exploring their structure and the distinction between active and passive funds.

Pooling Money for Diversified Investments

At its core, a mutual fund is a collective investment vehicle. It pools money from multiple investors to invest in a diversified portfolio of assets, which can include stocks, bonds, money market instruments, or other securities.

How does it work?

- Investment Objective: Each mutual fund has a specific investment objective, clearly outlined in its prospectus. This objective guides the fund’s investment strategy and asset allocation.

- Fund Manager: The pooled funds are managed by a professional fund manager or a team of managers. They make investment decisions based on research, market analysis, and the fund’s stated objective.

- Units and Net Asset Value (NAV): When you invest in a mutual fund, you receive ‘units’ proportional to your investment amount. The value of these units, expressed as NAV, fluctuates based on the total value of the fund’s underlying assets.

- Diversification: One of the primary advantages of mutual funds is diversification. Instead of investing in a single stock or bond, mutual funds spread the investment across multiple assets, reducing the risk associated with individual securities.

Active vs. Passive Mutual Fund

The mutual fund universe is broadly divided into two categories based on their management style: active and passive.

Active Mutual Funds:

- Objective: The primary goal is to outperform a specific benchmark index.

- Management: Actively managed by fund managers who make buy and sell decisions based on research, forecasts, and their judgment.

- Cost: Typically have higher expense ratios due to research costs and frequent trading.

- Performance: While some active funds succeed in outperforming their benchmarks, many struggle to consistently achieve this over the long term.

Passive Mutual Funds (Index Funds or ETFs):

- Objective: Aim to replicate the performance of a specific benchmark index.

- Management: Passively managed; the fund’s portfolio mirrors the components of the benchmark index.

- Cost: Generally have lower expense ratios as they don’t require active management or frequent trading.

- Performance: Their performance closely tracks that of the benchmark index, minus the minimal fees.

Comparison Table:

| Feature | Active Mutual Funds | Passive Mutual Funds |

|---|---|---|

| Objective | Outperform benchmark | Track benchmark |

| Management Style | Active | Passive |

| Costs | Higher | Lower |

| Potential for Outperformance | Yes | No |

Exchange-Traded Funds (ETFs) Explained

Exchange-Traded Funds, commonly known as ETFs, have surged in popularity over the past couple of decades. Offering a unique blend of features from both stocks and mutual funds, ETFs provide investors with a versatile tool to diversify their portfolios. In this section, we’ll demystify ETFs, explore their comparison with mutual funds, and delve into their inherent flexibility and diversity.

What are ETFs?

ETFs are investment funds that hold a collection of assets, such as stocks, bonds, or commodities, and are traded on stock exchanges, much like individual stocks. This means they can be bought and sold throughout the trading day at market prices, unlike mutual funds, which are priced once at the end of the trading day.

Comparing ETFs with Mutual Funds

While ETFs and mutual funds share similarities, such as pooling investors’ money to invest in a diversified portfolio, they have distinct differences:

| Feature | Active Mutual Funds | Passive Mutual Funds (Index Funds or ETFs) |

|---|---|---|

| Objective | The primary goal is to outperform a specific benchmark index. | Aim to replicate the performance of a specific benchmark index. |

| Management | Actively managed by fund managers who make buy and sell decisions based on research, forecasts, and their judgment. | Passively managed; the fund’s portfolio mirrors the components of the benchmark index. |

| Cost | Typically have higher expense ratios due to research costs and frequent trading. | Generally have lower expense ratios as they don’t require active management or frequent trading. |

| Performance | While some active funds succeed in outperforming their benchmarks, many struggle to consistently achieve this over the long term. | Their performance closely tracks that of the benchmark index, minus the minimal fees. |

The Flexibility and Diversity of ETFs

- Broad Market Exposure: ETFs allow investors to gain exposure to entire market segments, industries, or asset classes with a single purchase. For instance, an S&P 500 ETF provides exposure to all 500 companies in the index.

- Niche Investments: Beyond broad market ETFs, there are specialized ETFs that focus on specific sectors, themes, or even strategies. Examples include clean energy ETFs, technology sector ETFs, or dividend-focused ETFs.

- Global Reach: ETFs offer an easy way to invest in international markets, commodities, or currencies without the complexities of direct foreign investments.

- Liquidity: Popular ETFs tend to have high trading volumes, ensuring liquidity and tighter bid-ask spreads.

- Flexibility in Trading: Investors can employ various stock trading techniques with ETFs, such as limit orders, stop-loss orders, and even short selling.

- Dividend Yields: Many ETFs pay dividends based on the income generated by the underlying assets, providing an income stream for investors.

Stocks: Owning a Piece of a Company

The allure of the stock market has captivated investors for centuries. At its core, buying stocks means purchasing a piece of a company, becoming a shareholder, and owning a fraction of its value and potential future earnings. This ownership comes with its set of rights, rewards, and risks.

Understanding Shares and Dividends

- Shares: When a company decides to raise capital by selling a portion of its ownership to the public, it issues shares. Each share represents a unit of ownership in the company. As a shareholder, you essentially own a slice of the company’s assets, earnings, and potential future growth.

- Dividends: These are a portion of a company’s profits distributed to shareholders. Not all companies pay dividends; some might reinvest all their profits back into the business. However, those that do typically pay them on a regular basis, such as quarterly. The amount you receive depends on the number of shares you own and the amount allocated per share.

Common vs. Preferred Stock

While both types of stocks represent ownership in a company, they come with distinct rights and characteristics:

Common Stock:

- Voting Rights: Common stockholders usually have the right to vote on company matters, such as electing board members or approving mergers. Typically, each share equals one vote.

- Dividends: Dividends for common stockholders are not guaranteed and can fluctuate based on the company’s performance and decisions by its board of directors.

- Capital Appreciation: Common stocks have the potential for significant capital appreciation, but they also come with higher volatility.

- Residual Claim: In the unfortunate event of company liquidation, common stockholders are last in line to claim any remaining assets, after bondholders and preferred stockholders.

Preferred Stock:

- Dividend Priority: Preferred stockholders receive dividends before common stockholders. These dividends are usually fixed and are paid out regularly.

- No Voting Rights: Typically, preferred stockholders do not have voting rights in the company.

- Liquidation Preference: In case of company liquidation, preferred stockholders have a higher claim on assets than common stockholders, though they still come after bondholders.

- Convertible Options: Some preferred stocks come with the option to convert them into a predetermined number of common shares.

Comparison Table:

| Feature | Common Stock | Preferred Stock |

|---|---|---|

| Voting Rights | Usually Yes | Typically No |

| Dividends | Variable | Fixed |

| Capital Appreciation | Higher Potential | Limited |

| Liquidation Claim | Last | Before Common Stock |

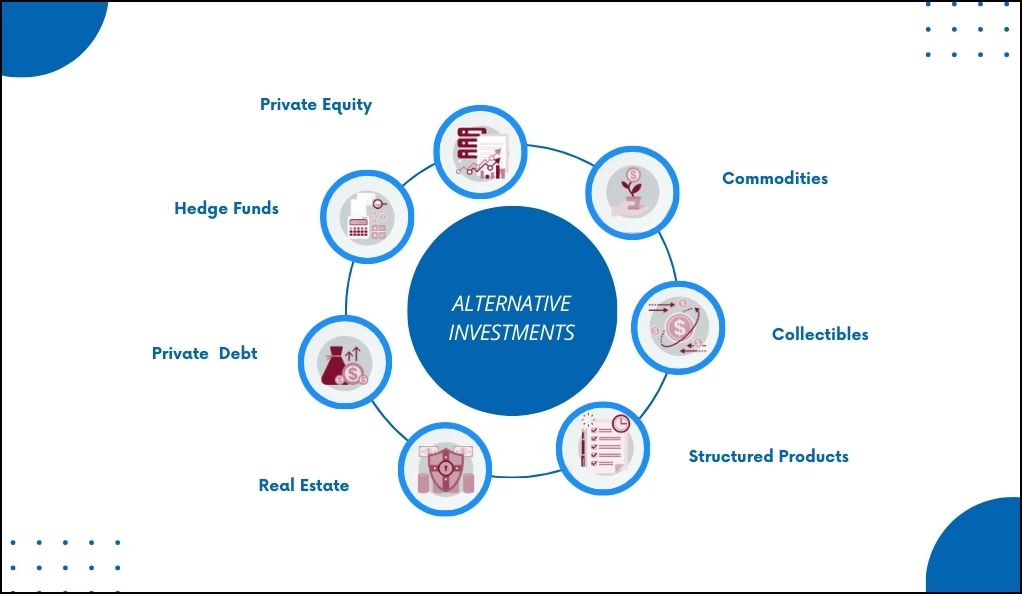

Alternative Investments: Beyond the Basics

In the diverse realm of investment opportunities, there exists a category that often resides outside the traditional stock and bond portfolios: alternative investments. These assets, ranging from real estate to hedge funds and private equity, offer a different risk-reward profile and can add a layer of diversification to an investor’s portfolio. Let’s journey beyond the basics and delve into the world of alternative investments, understanding their allure, potential benefits, and inherent risks.

Key Alternative Investments

- Real Estate:

- Description: This involves investing in physical properties, whether residential, commercial, or industrial. Real estate can also be accessed through Real Estate Investment Trusts (REITs), which pool funds to invest in properties or mortgages and trade like stocks.

- Potential Benefits: Real estate can offer rental income, tax benefits, and capital appreciation. It’s also a tangible asset, providing a hedge against inflation.

- Hedge Funds:

- Description: These are pooled investment funds that employ various strategies to generate high returns for their investors. They might invest in equities, derivatives, currencies, and even real estate.

- Potential Benefits: Hedge funds aim to achieve positive returns regardless of market conditions, offering diversification and potentially higher returns.

- Private Equity:

- Description: Private equity involves investing directly in private companies or buying out public companies to make them private. The goal is to improve their value and eventually sell the stake at a profit.

- Potential Benefits: Private equity can offer significant returns if the invested companies grow or improve their performance.

Key Alternative Investments

- Real Estate:

- Description: This involves investing in physical properties, whether residential, commercial, or industrial. Real estate can also be accessed through Real Estate Investment Trusts (REITs), which pool funds to invest in properties or mortgages and trade like stocks.

- Potential Benefits: Real estate can offer rental income, tax benefits, and capital appreciation. It’s also a tangible asset, providing a hedge against inflation.

- Hedge Funds:

- Description: These are pooled investment funds that employ various strategies to generate high returns for their investors. They might invest in equities, derivatives, currencies, and even real estate.

- Potential Benefits: Hedge funds aim to achieve positive returns regardless of market conditions, offering diversification and potentially higher returns.

- Private Equity:

- Description: Private equity involves investing directly in private companies or buying out public companies to make them private. The goal is to improve their value and eventually sell the stake at a profit.

- Potential Benefits: Private equity can offer significant returns if the invested companies grow or improve their performance.

The Allure and Risks of Alternative Investments

Allure:

- Diversification: Alternative investments often have a low correlation with traditional stocks and bonds, providing diversification benefits and potentially reducing portfolio volatility.

- Potential for Higher Returns: Some alternative assets, especially hedge funds and private equity, aim for returns that outpace traditional markets.

- Inflation Hedge: Assets like real estate can act as a hedge against inflation, preserving the purchasing power of your investments.

- Access to Niche Markets: Alternative investments can provide exposure to specific markets or strategies not easily accessible through traditional means.

Risks:

- Lack of Liquidity: Many alternative investments, like real estate or private equity, are not as liquid as stocks or bonds. This means they can’t be easily sold or converted to cash.

- Complexity: Hedge funds, in particular, might employ complex strategies that can be hard to understand for the average investor.

- Higher Fees: Alternative investments, especially hedge funds and private equity, often come with higher fees compared to traditional assets.

- Limited Transparency: Some alternative investments do not have the same level of regulatory oversight or transparency as traditional securities, making it challenging to assess their performance and risks.

- Potential for Significant Losses: While there’s a potential for higher returns, the risks are also elevated. It’s possible to experience substantial losses in alternative investments.

Alternative investments offer a unique avenue for seasoned investors to diversify their portfolios, tap into niche markets, and potentially achieve higher returns. However, with the allure comes a set of risks that require careful consideration. As with any investment decision, thorough research, understanding the underlying assets, and possibly consulting with financial professionals are crucial steps before venturing into the world of alternative investments.

Crafting a Sensible Investment Strategy

In the intricate dance of financial markets, having a well-thought-out investment strategy is akin to having a reliable compass. It guides you through the ebbs and flows, helping you make informed decisions that align with your financial aspirations. A sensible strategy is not just about picking the right assets but understanding the broader principles of diversification, risk tolerance, and goal-setting.

The Importance of Diversification

“Diversification” is more than just a buzzword in the investment world; it’s a foundational principle.

- Risk Mitigation: By spreading investments across various asset classes or sectors, you reduce the impact of a poor-performing asset on your overall portfolio. In other words, the underperformance of one asset can be offset by the strong performance of another.

- Access to Multiple Opportunities: Diversification allows you to tap into different markets or sectors, each with its growth potential.

- Protection Against Volatility: A diversified portfolio can provide a buffer against market volatility, ensuring that a downturn in one sector doesn’t severely impact your entire investment.

Tailoring Your Investment Strategy

Every individual’s financial journey is unique, shaped by personal aspirations, life stages, and risk appetite. Thus, a one-size-fits-all approach rarely works. Here’s how to tailor your strategy:

- Assessing Risk Tolerance:

- Conservative: If you’re risk-averse, you might lean towards bonds, cash, or blue-chip stocks. This approach prioritizes capital preservation over high returns.

- Moderate: A balanced approach might involve a mix of equities and bonds, aiming for steady growth while maintaining some level of security.

- Aggressive: If you’re open to taking risks for potentially higher returns, you might have a portfolio dominated by equities, including high-growth stocks or emerging markets.

- Defining Financial Goals: Your investment strategy should align with your financial milestones. Are you saving for a down payment on a house, your child’s education, or retirement? Each goal might have a different time horizon and, therefore, a different asset allocation.

- Regular Review and Rebalancing: The financial landscape is dynamic. Regularly reviewing your portfolio ensures it aligns with your goals. Rebalancing involves adjusting your asset allocation, selling high-performing assets, and buying underperforming ones to maintain your desired risk-reward ratio.

- Stay Informed: The world of investments is ever-evolving. From geopolitical events to technological advancements, various factors can influence markets. Staying informed helps you make timely adjustments to your strategy.

- Seek Expertise: While self-education is invaluable, consulting with financial advisors or experts can provide insights tailored to your specific situation. They can help navigate complex financial decisions, tax implications, and offer a holistic view of your financial health.

Crafting a sensible investment strategy is a continuous journey of learning, adapting, and growing. It’s about striking a balance between risk and reward, being proactive yet patient, and always keeping an eye on the ultimate prize: achieving your financial goals. Remember, the journey is as crucial as the destination, and a well-thought-out strategy ensures you navigate it with confidence.

Conclusion

In the ever-evolving tapestry of the financial world, a well-structured investment strategy stands as an anchor, guiding individuals through the complexities of various asset classes. From the foundational principles of diversification to the nuanced art of tailoring investments based on individual risk appetites and goals, the journey of investing is both intricate and enlightening. It’s not merely about chasing returns but understanding the broader dynamics of markets, the interplay of assets, and the importance of being informed and adaptable.

The essence of a successful investment journey lies in its personalization. Every individual’s financial aspirations, life stages, and risk thresholds are unique, necessitating a strategy that’s tailored rather than templated. Whether it’s the tangible allure of real estate, the high-growth potential of stocks, or the stability of bonds, the key is to find the right mix that aligns with one’s goals and risk tolerance. And while self-reliance and education are invaluable, the insights from financial experts can provide an added layer of clarity and direction.

In conclusion, the realm of investing, with its myriad opportunities and challenges, offers a profound lesson in patience, knowledge, and adaptability. It underscores the importance of not just where you invest, but how you approach the entire process. As the financial landscape continues to shift and evolve, those equipped with a robust, flexible, and informed strategy will be best positioned to navigate the waves and achieve their financial aspirations.

At bitvestment.software, our commitment is to deliver unbiased and reliable information on subjects like cryptocurrency, finance, trading, and stocks. It's crucial to understand that we are not equipped to offer financial advice, and we actively encourage users to conduct their own comprehensive research.

Read More